Did You Manage To Avoid Quickstep Holdings's (ASX:QHL) Painful 60% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Quickstep Holdings Limited (ASX:QHL) share price is a whole 60% lower. That's an unpleasant experience for long term holders. Unhappily, the share price slid 1.2% in the last week.

View our latest analysis for Quickstep Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

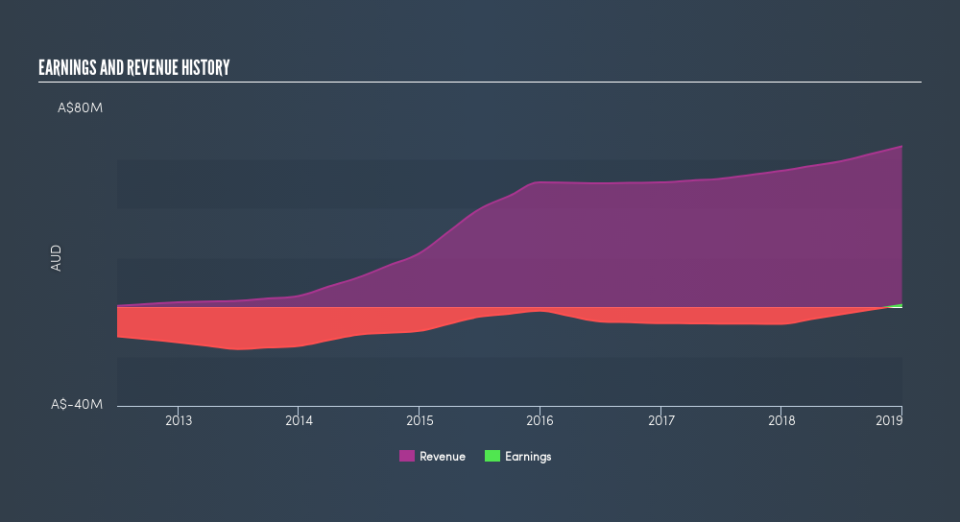

During five years of share price growth, Quickstep Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Revenue is actually up 26% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We know that Quickstep Holdings has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Quickstep Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Quickstep Holdings provided a TSR of 6.6% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 16% per year, over five years. It could well be that the business is stabilizing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Quickstep Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance