Did You Manage To Avoid Keytone Dairy's (ASX:KTD) 13% Share Price Drop?

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Keytone Dairy Corporation Limited (ASX:KTD) share price is down 13% in the last year. That's disappointing when you consider the market returned 24%. Keytone Dairy may have better days ahead, of course; we've only looked at a one year period. It's down 19% in about a quarter.

View our latest analysis for Keytone Dairy

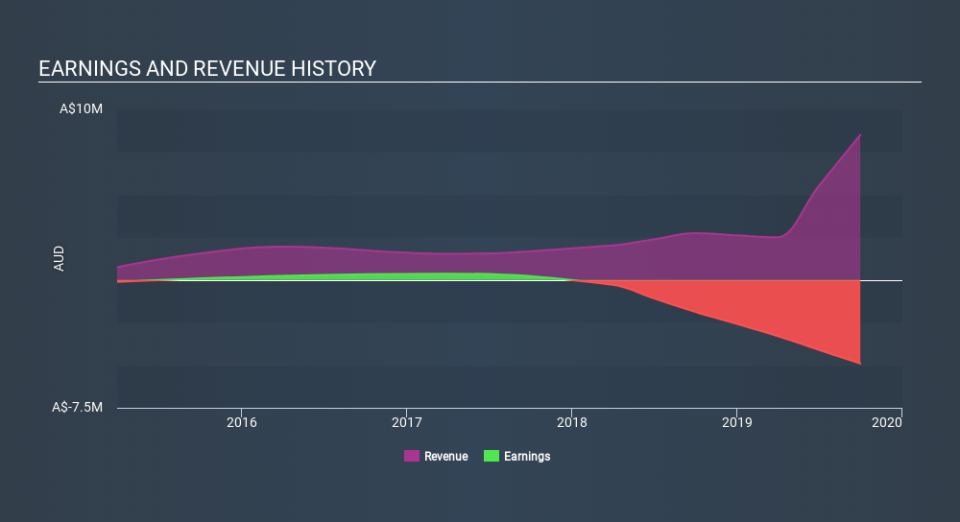

Keytone Dairy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Keytone Dairy grew its revenue by 210% over the last year. That's well above most other pre-profit companies. The share price drop of 13% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Given that the market gained 24% in the last year, Keytone Dairy shareholders might be miffed that they lost 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 19% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Keytone Dairy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance