Did Fortive's (NYSE:FTV) Share Price Deserve to Gain 35%?

While Fortive Corporation (NYSE:FTV) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. On the other hand the share price is higher than it was three years ago. In that time, it is up 35%, which isn't bad, but not amazing either.

Check out our latest analysis for Fortive

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, Fortive failed to grow earnings per share, which fell 4.7% (annualized). Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Fortive at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.4% dividend yield is unlikely to be propping up the share price. Do you think that shareholders are buying for the 2.5% per annum revenue growth trend? We don't. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

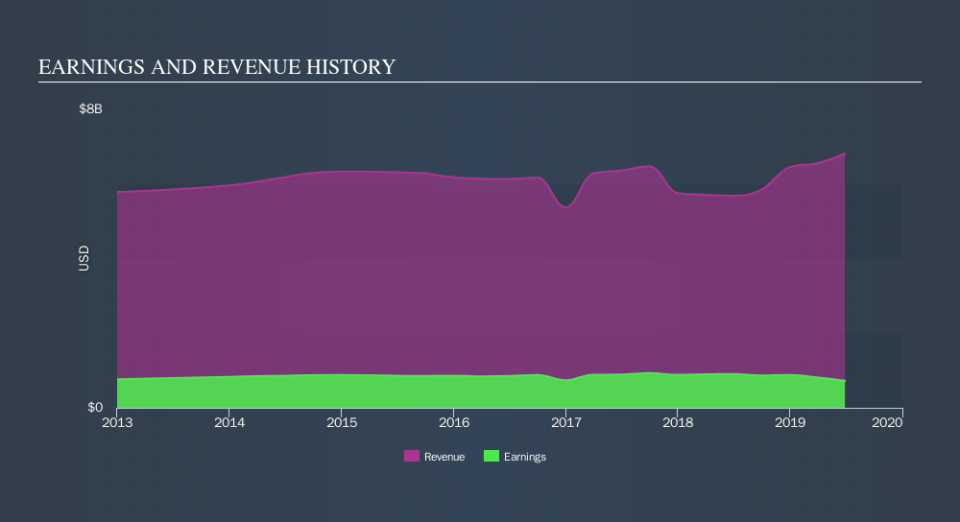

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Fortive is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Fortive will earn in the future (free analyst consensus estimates)

A Different Perspective

The last twelve months weren't great for Fortive shares, which cost holders 20%, including dividends, while the market was up about 3.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 11% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before spending more time on Fortive it might be wise to click here to see if insiders have been buying or selling shares.

We will like Fortive better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance