Did Changing Sentiment Drive Isodiol International's (CSE:ISOL) Share Price Down A Painful 94%?

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held Isodiol International Inc. (CSE:ISOL) during the last year don't lose the lesson, in addition to the 94% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. Because Isodiol International hasn't been listed for many years, the market is still learning about how the business performs. More recently, the share price has dropped a further 48% in a month. But this could be related to poor market conditions -- stocks are down 30% in the same time.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Isodiol International

Because Isodiol International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Isodiol International's revenue didn't grow at all in the last year. In fact, it fell 18%. That looks pretty grim, at a glance. The market obviously agrees, since the share price tanked 94%. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

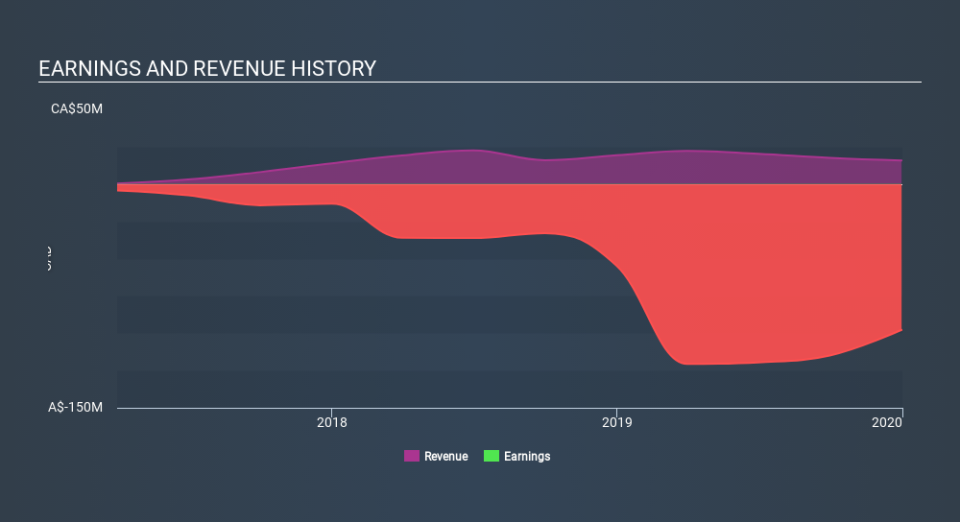

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Isodiol International's earnings, revenue and cash flow.

A Different Perspective

We doubt Isodiol International shareholders are happy with the loss of 94% over twelve months. That falls short of the market, which lost 25%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 36% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Isodiol International better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Isodiol International (including 2 which is are a bit concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance