DEUTZ And Two More Top Dividend Stocks In Germany

Amidst a backdrop of political uncertainty and fluctuating market indices across Europe, Germany's economic landscape presents a complex yet intriguing environment for dividend stock investors. In this context, understanding the fundamental strengths of dividend-yielding stocks becomes crucial, especially in navigating through periods of market volatility and economic unpredictability.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.35% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.90% | ★★★★★★ |

Brenntag (XTRA:BNR) | 3.26% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 6.59% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.88% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.79% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.36% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.21% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.30% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.11% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

DEUTZ

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across various global regions, with a market capitalization of approximately €0.62 billion.

Operations: DEUTZ Aktiengesellschaft generates revenue primarily through two segments: Classic, which brought in €2.01 billion, and Green, contributing €5.30 million.

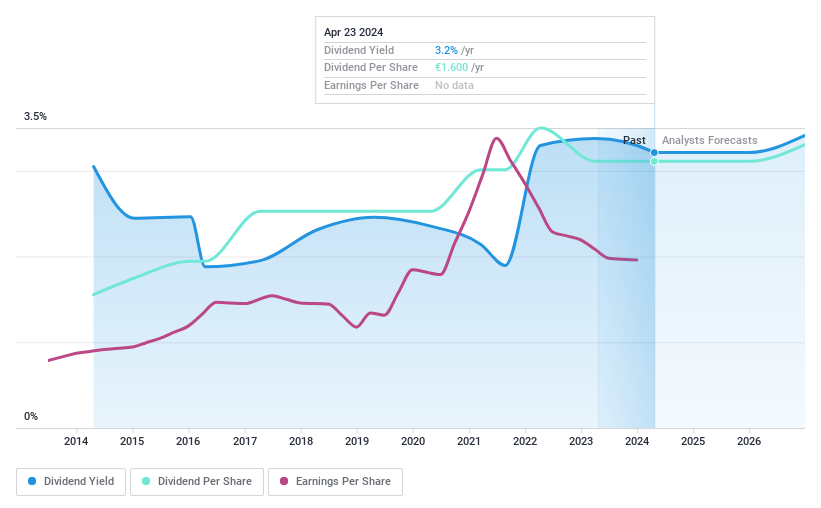

Dividend Yield: 3.4%

DEUTZ reported a decrease in Q1 sales to €454.7 million and net income to €8.8 million, reflecting a challenging quarter compared to the previous year. Despite this, DEUTZ maintains a cash payout ratio of 34.6%, indicating dividends are well-covered by cash flow but has shown an unstable dividend track record over the past decade with volatile payments. The company trades at 68.5% below estimated fair value, suggesting potential undervaluation relative to its performance metrics and industry peers.

SAF-Holland

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAF-Holland SE specializes in manufacturing and supplying chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market capitalization of approximately €0.84 billion.

Operations: SAF-Holland SE generates revenue from three primary geographical segments: Americas (€898.79 million), Asia/Pacific including China and India (€280.64 million), and Europe, the Middle East, and Africa (EMEA) with €951.75 million.

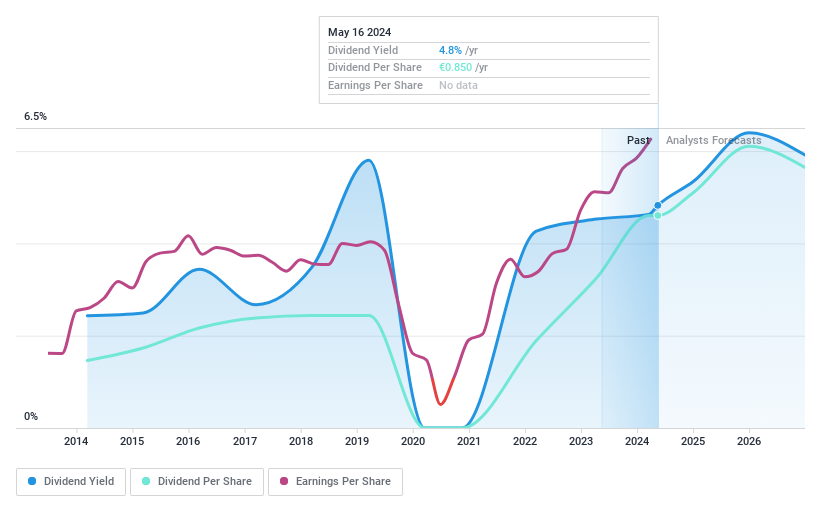

Dividend Yield: 4.6%

SAF-Holland SE demonstrated a robust Q1 2024, with sales increasing to €505.43 million and net income rising to €26.23 million. Despite a low dividend yield of 4.57% against the German market's top quartile at 4.72%, its dividends are well-supported by a payout ratio of 44.6% and a cash payout ratio of 31.6%. However, the company has faced challenges with inconsistent dividend payments over the last decade, coupled with high debt levels, which could concern conservative dividend investors seeking stability.

Uzin Utz

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE, with a market cap of €259.78 million, is a company that develops, manufactures, and sells construction chemical system products across Germany, the United States, the Netherlands, and other international markets.

Operations: Uzin Utz SE generates its revenue through various segments, with notable contributions from Germany - Laying Systems (€210.21 million), Western Europe (€83.83 million), Netherlands - Laying Systems (€82.87 million), USA (€73.33 million), and smaller segments in the Netherlands - Wholesale (€36.31 million), Germany - Surface Care and Refinement (€35.16 million), and Southern/Eastern Europe (€25.98 million).

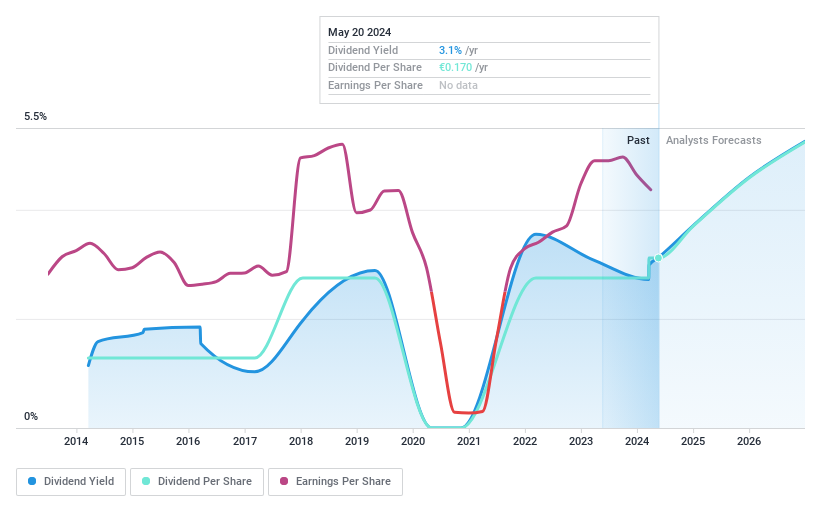

Dividend Yield: 3.1%

Uzin Utz SE offers a steady dividend yield of 3.11%, underperforming the top 25% of German dividend stocks at 4.72%. Its dividends, however, are well-supported by a payout ratio of 35.7% and an even lower cash payout ratio of 23.9%, indicating strong coverage by both earnings and cash flow. Despite this reliability, with dividends increasing over the past decade and earnings forecast to grow annually by 5.64%, the company's recent financials show a slight decline in net income from €25.31 million to €22.58 million year-over-year, alongside a drop in sales from €487.13 million to €479.34 million as reported on March 27, 2024.

Get an in-depth perspective on Uzin Utz's performance by reading our dividend report here.

Upon reviewing our latest valuation report, Uzin Utz's share price might be too optimistic.

Turning Ideas Into Actions

Take a closer look at our Top Dividend Stocks list of 32 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:DEZ XTRA:SFQ and XTRA:UZU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance