Dermata (DRMA) Up on FDA Nod to Begin Pivotal Study of Acne Drug

Dermata Therapeutics, Inc. DRMA, a clinical-stage company, announced reaching an agreement with the FDA regarding the protocols of a phase III study of DMT310 in the treatment of acne. The agreement allows the company to begin a late-stage pivotal clinical program for DMT310 in treating acne.

DRMA is gearing up to begin enrolling patients in the first phase III STAR-1 study of the pivotal clinical program in December 2023. Shares of Dermata rose 6.9% on Thursday in response to the encouraging regulatory update.

The company’s novel, once-weekly and topical product candidate, DMT310, is derived from a freshwater sponge and being developed for the treatment of multiple skin diseases. DMT310 has several mechanisms of action that include mechanical and chemical compounds to help treat inflammatory skin diseases like acne.

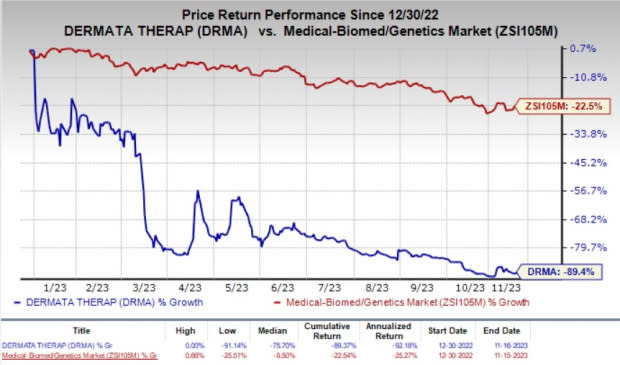

Year to date, shares of Dermata have plunged 89.4% compared with the industry’s 22.5% decline.

Image Source: Zacks Investment Research

Per Dermata, the pivotal phase III clinical program for DMT310 will include two late-stage studies to evaluate the efficacy, safety and tolerability of DMT310 in patients with moderate-to-severe facial acne. The company plans to enroll about 550 acne patients aged nine years and older in the United States and Latin America in each phase III study.

The total patient populations in both studies will be randomly divided into two cohorts in the ratio of 2:1. The patients will be treated once weekly for 12 weeks with either DMT310 or placebo and evaluated monthly.

The primary endpoints of the DMT301 pivotal clinical program are the mean change from baseline in inflammatory and noninflammatory lesion counts and the Investigator Global Assessment (IGA) response rate. IGA is a metric in the assessment of treatment response.

Subject to positive results from the phase III STAR-1 study, the company plans to use the data to support a regulatory filing with the FDA for the approval of DMT301 in the acne indication.

Dermata also reported that DMT310 has previously shown positive treatment effects in moderate-to-severe acne in a phase IIb study. Once-weekly, topical administration of DMT310 achieved statistically significant results at all time points for all primary and secondary endpoints.

Furthermore, it was observed that almost 45% of patients achieved an IGA score of clear or almost clear upon treatment with DMT310 compared with less than 18% of placebo patients achieving the same at the end of 12 weeks.

Acne is a kind of skin condition, which, although not fatal, can take a serious toll on the quality of life of people suffering from it.

Dermata Therapeutics, Inc. Price and Consensus

Dermata Therapeutics, Inc. price-consensus-chart | Dermata Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Dermata currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks worth mentioning are Ligand Pharmaceuticals LGND, Acadia Pharmaceuticals ACAD and Anixa Biosciences ANIX. While LGND sports a Zacks Rank #1 (Strong Buy), ACAD and ANIX carry a Zacks Rank #2 (Buy) each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2023 earnings per share has remained constant at $5.10. During the same time frame, the estimate for Ligand’s 2024 earnings per share has remained constant at $4.59. Year to date, shares of LGND have lost 14.5%.

LGND’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 67.19%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has narrowed from 37 cents to 34 cents. The estimate for Acadia’s 2024 earnings per share is pegged at 90 cents. Year to date, shares of ACAD have gained 38.6%.

ACAD beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

In the past 30 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has remained constant at 32 cents. During the same time frame, the estimate for Anixa Biosciences’ 2024 loss per share has remained constant at 37 cents. Year to date, shares of ANIX have lost 32.2%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 26.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report

Dermata Therapeutics, Inc. (DRMA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance