Delphi Technologies (DLPH) Beats on Q1 Earnings & Revenues

Delphi Technologies DLPH reported solid first-quarter 2020 results wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings per share of 22 cents outpaced the consensus mark by more than 100% but decreased 67% year over year.

Total revenues of $945 million surpassed the consensus estimate by 9.5% but decreased 18% year over year on a reported basis and 16% on an adjusted basis (adjustments were made for currency exchange). The downside was mainly due to lower global production and the closure of customer production sites related to coronavirus outbreak and the downward trend in passenger car diesel fuel injection systems in Europe, partially offset by solid growth in advanced gasoline direct injection fuel systems.

So far this year, shares of Delphi Technologies have decreased 10.8% compared with 3.8% decline of the industry it belongs to.

Revenues in Detail

Segment-wise, Fuel Injection Systems revenues of $393 million declined 13% year over year.Powertrain Systems revenues of $261 million decreased 20% year over year. Electrification & Electronics revenues of $178 million declined 27% year over year. Delphi Technologies Aftermarket revenues of $174 million declined 10% year over year.

Region-wise, adjusted revenues declined 20% in Europe, 23% in North America and 15% in South America, partially offset by 6% growth in Asia Pacific, including an increase of 12% in China.

Operating Results

Adjusted operating income of $40 million decreased 54% from the prior-year quarter. Adjusted operating income margin of 4.2% declined 340 basis points from the prior-year quarter.

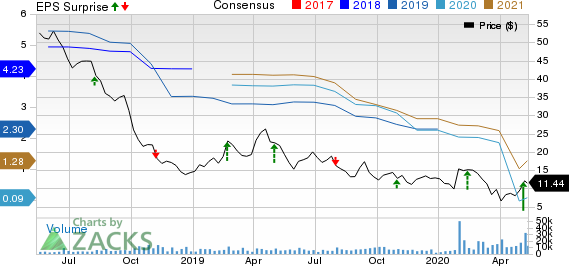

Delphi Technologies PLC Price, Consensus and EPS Surprise

Delphi Technologies PLC price-consensus-eps-surprise-chart | Delphi Technologies PLC Quote

Balance Sheet and Cash Flow

Delphi Technologies exited first-quarter 2020 with cash and cash equivalents of $611 million compared with $191 million at the end of the prior quarter. Long-term debt was $1.94 billion compared with $1.46 billion at the end of the prior quarter.

The company generated $31 million of cash from operating activities in the reported quarter. Capital expenditure totaled $85 million.

Currently, Delphi Technologies carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

S&P Global Inc. SPGI first-quarter 2020 adjusted earnings per share of $2.73 beat the consensus mark by 15.7% and improved 29.4% year over year on the back of revenue growth, benefits of productivity initiatives and reduced business travel. The stock currently carries a Zacks Rank #3.

IQVIA Holdings Inc. IQV first-quarter 2020 adjusted earnings per share of $1.50 beat the consensus mark by 1.4% but decreased 1.9% on a year-over-year basis. The reported figure lies within the guided range of $1.46-$1.51. The stock currently carries a Zacks Rank #3.

Insperity, Inc. NSP first-quarter 2020 adjusted earnings of $1.70 per share beat the consensus mark by 5.6% but decreased 14.1% year over year. The reported figure matched the higher end of the guided range of $1.61-$1.70. The stock currently carries a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Insperity Inc (NSP) : Free Stock Analysis Report

Delphi Technologies PLC (DLPH) : Free Stock Analysis Report

SP Global Inc (SPGI) : Free Stock Analysis Report

IQVIA Holdings Inc (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance