'A tax on future generations': U.S. debt on path to exceed World War II levels

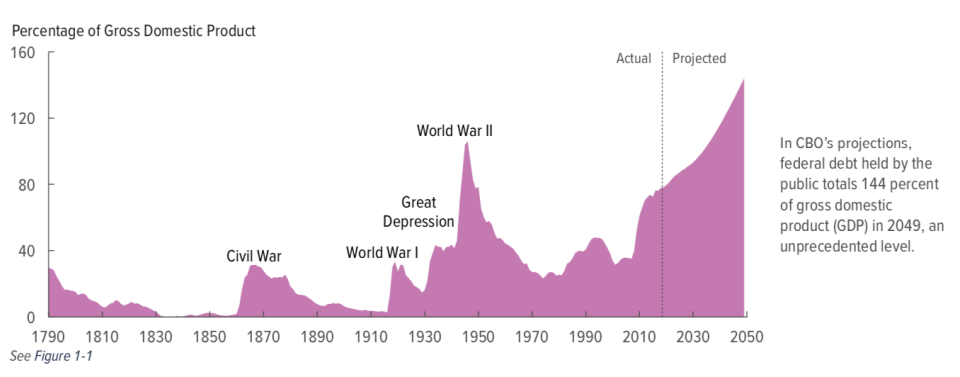

U.S. federal debt is on track to balloon to a staggering 144% of GDP, according to a recent report by the Congressional Budget Office (CBO).

“Large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels… from 78 percent of gross domestic product (GDP) in 2019 to 144 percent by 2049,” the report stated.

Testifying to the House Financial Services Committee on Wednesday, Federal Reserve Chair Jerome Powell highlighted the national debt.

“The United States’ federal budget is on an unsustainable path in the sense that spending is growing faster than the economy… I think we’re racking up greater and greater debt,” he told the Congress. “It’s something that’s important over the longer-run… What will happen if we don’t do is that we’ll wind up spending more and more on interest and less and less on the things that we really need to spend money on.”

‘144% is genuinely scary’

Some experts see the debt as a “tax” on future generations.

“What this is is a tax on future generations and a lowering of the standard of living for our children and our grandchildren in the future,” Bipartisan Policy Center Senior Vice President G. William Hoagland told Yahoo Finance. “It’s a hard one for politicians who are worried about the election, two years down the road, or six years down the road, to think out that far.”

Based on the CBO’s projections — which factored in productivity growth and interest rates on federal debt — if current laws “generally remained unchanged,” they expect debt to reach 92% of GDP by the end of the next decade and 144% by 2049.

“144% is genuinely scary – the more so because it is rising rapidly with no indication of anything to turn it around,” Joseph Minarik, former chief economist at the Office of Management and Budget during the Clinton administration, told Yahoo Finance.

The key reason why U.S. federal debt is reaching extreme levels is because the law that exists today that determines taxes and benefits — such as Social Security and major health care programs — has strained its resources considerably.

Downsides to debt

When federal debt balloons, two things happen, the CBO explained.

Firstly, debt would “dampen economic output over time.” And when interest costs on that level of outstanding debt rises, interest payments to foreign debt holders also increases, which then in turn reduces the income of Americans households.

Secondly, at the projected debt levels, the U.S. would be more likely to fall into a fiscal crisis when the interest rate on that debt rose.

And if investors begin to lose confidence in the U.S. and its fiscal position, it could trigger “expectations of higher rates of inflation and more difficulty financing public and private activity in international markets,” the report said.

“There could be a point where foreign investors say they’d rather invest in Africa or Saudi Arabia or someplace else. And we’d have to fund our deficits and debt,” added Hoagland, who is also a long-time D.C. operator.

“And that means that we’d have to increase rather dramatically our interest rates to attract [them]. There’s a price to this. So I worry about… the loss of sovereignty with this level of debt, and particularly who owns it.”

‘The longer we wait to fix the problem, the bigger the eventual bang’

The last time debt was this high was right after World War Two in 1946, when President Harry Truman was in office.

The public debt as a percentage of GDP was 106%. The country had just emerged victorious from a war and debt was falling, the labor market was revitalized by millions of men returning from the war, and Truman lessened the debt load by massively scaling back spending (even though it was politically unpopular).

The current administration under President Donald Trump entered office with the second-highest level of debt-to-GDP ratio at 77%. And the administration’s policies are adding to the deficit.

“I work for Republicans, I still think I’m a Republican — maybe not a Trump card-carrying Republican — but… I have to say that there are lots of public debates out here today, and I would argue that we should pay for these things,” Hoagland said.

“I think they’re good... we need childcare… we need parental aid... we need infrastructure investment. But let’s admit, if going to do that, let’s start paying for it. … Or else, let’s admit right up front, we need additional revenues. Or else we’re simply… taxing future generations.”

And “the longer we wait to fix the problem, the bigger the eventual bang,” Minarik said. “If the financial markets lose trust in the Treasury and demand higher interest rates… given the size of our debt would render us toast very quickly.”

Not everyone agrees that these high debt levels are not necessarily a bad thing. And for experts like Minarik and Hoagland, that lack of concern is disheartening.

“I’ve been at this for a long time… but I see now that there is there’s a there’s a sense out here that deficits don’t matter. Debt doesn’t matter,” said Hoagland. “There are days that I think, well, why have I spent my career worrying about something that nobody seems to think matters at all? ...

“It almost makes you feel like you’ve wasted your time and your career.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Fed Chair Powell: 'The U.S. federal government is on an unsustainable fiscal path'

How the ballooning $22 trillion national debt will affect Americans

'Unhinged madman': Former U.S. budget director says Trump is 'conducting 4 wars on the economy'

2019 tax refund size down nearly 17% on average, IRS reports

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance