DAX Index Fundamental Analysis – week of February 26, 2018

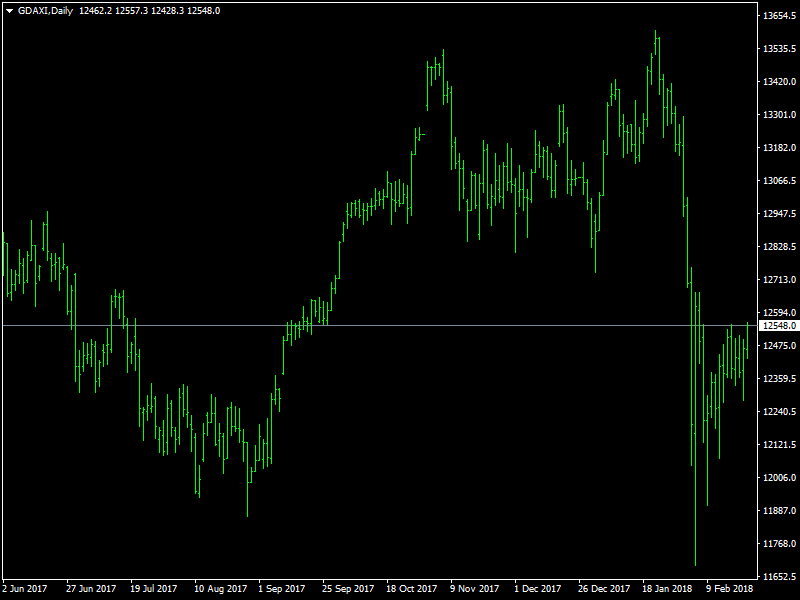

The DAX index continued to move higher for another week as the stock markets around the world are in a recovery mode after the mighty fall a few weeks before. That fall has shaken the confidence of the investors due to the fact that the fall was quick and steep as well and there was not much fundamentals or economic data to support that fall. That has given cause for concern for the traders.

DAX Treads Cautiously

The investors are worried that there might be another fall, with not much of reason whatsoever, in the near future and that is why we are seeing them tread cautiously not only on the DAX but also in the rest of the global markets as well. There has been a good rebound in most of the stock markets but they are still at a loss when compared to the levels before the fall came along and we doubt whether we would be seeing those levels back again in the near future. It is likely to take a long time to rebuild the confidence of the investors.

The European stock markets have been hit especially hard as they are affected not only by the falling confidence of the investors and the traders but also by the possibility of the QE coming to an end. The tapering of the QE is likely to start within a few months and when that begins, we are going to see the funds begin to dry up for the stock markets. In that situation, the indices would come under pressure and that is why we are seeing this uncertainty hogging the DAX over the last couple of weeks, despite the improving data from Germany and the rest of the Eurozone as well.

Looking at the upcoming week, we are heading towards the end of the month and hence there is likely to be a lot of month end flows and it is also likely that we would be seeing the traders and investors close their positions and options for the month and roll it over to the next month. Also, we have speeches from Draghi and Powell as well and this is also likely to have an impact on the DAX in the coming week. We believe that the index is likely to stay buoyed but at the same time, it is likely to trade within a specific range in a mode of consolidation as the market still would like to see more signs of a rebound and a reversal before it decides to push the index higher. Till then, it is likely to be under pressure.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance