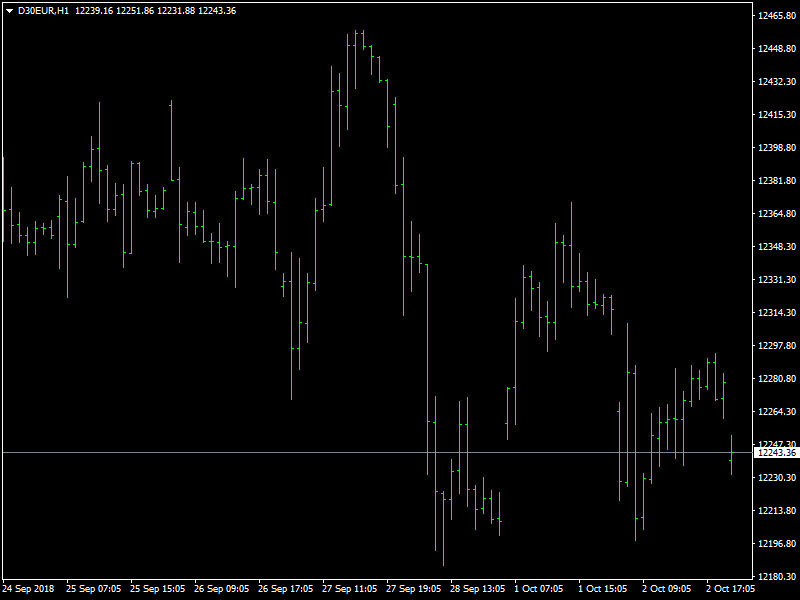

DAX Index Daily Price Forecast – DAX Under Pressure

The DAX is likely to come under pressure over the next few sessions as the dollar has got some renewed strength on the back of comments from the Fed Chief Powell. He has made it clear that the Fed policy could lead to even more rate hikes in the months to come and also made it clear that the rate hike cycle is not close to an end at this point of time. This is contrary to what the market had been believing till then and the traders were preparing themselves for a bout of dollar weakness and strength in the markets.

DAX Likely to Break Support

These statements from Powell late in the US session has put paid to such hopes and has led to weakness in many of the major markets around the world. It looks as though it is only a matter of time before the weakness sets in, in a large way and we will know more about that when the DAX and the other European indices open later in the day. The support region around 12200 is expected to come under severe test when the DAX opens up for the day and a break of that could open up 12000 and lower for the index.

This would also negate the inverse head and shoulder formation that we have been seeing on the daily and a failure of that would lead to many traders beginning to sell across the markets and this would only add to the pressure on the index. The bulls would feel that this region is the last place of standing for them and they would want to make sure that this region holds so that they can retain control of the markets. A break below 12200 could open up 12000 in quick time and this will then be followed by a trip towards the 11600 region as the bears seize control beyond the break of support.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Futures (GC) Technical Analysis – October 4, 2018 Forecast

USD/JPY Fundamental Daily Forecast – Traders May Be Taking Breather Ahead of Friday’s NFP Report

US Yields Accelerate Extremely Higher, Dollar Rises Sharply to Six-Week Highs

Crude Oil Price Update – Trade Through $74.30 Changes Minor Trend to Down, Shifts Momentum

Yahoo Finance

Yahoo Finance