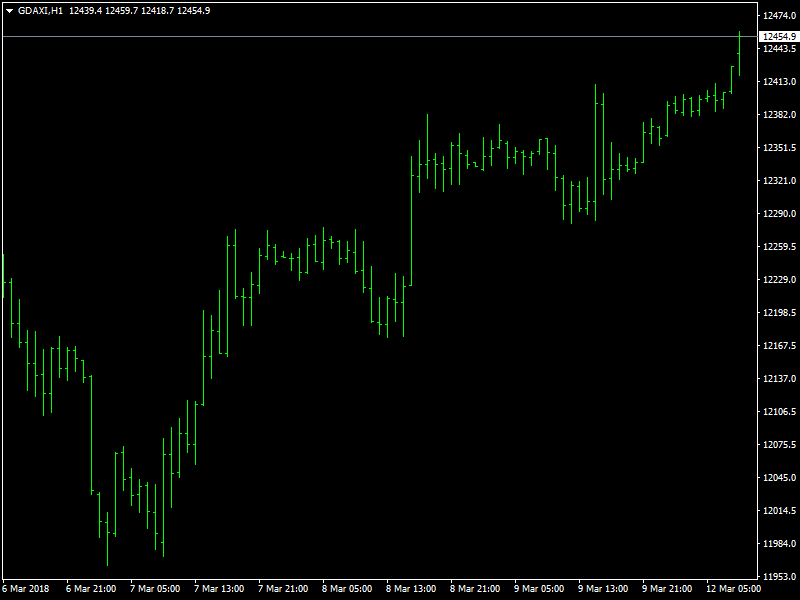

DAX Index Daily Fundamental Forecast – March 12, 2018

The DAX index would be looking to move higher when it opens for trading for today as the index is likely to take the cue from the US stock indices which closed near their highs on Friday. The stock markets were buoyed by the tariff plan being watered down to a great extent and also due to the strong employment data from the US and this should help the rest of the global markets to move higher.

DAX Spurred By US Data

The stock indices in the US were buoyed by the strong economic data from the US where the NFP came in much stronger than expected. Though the data was a bit tempered down when the fact that the average wages had gone down, the stock markets and the investors had seen enough and were intent on moving the stock markets higher. This was due to the fact that they now believe that it would be possible for the Fed to hike 4 times this year.

This was a distinct possibility a few weeks earlier as it needed the incoming data to continue to be strong but with each passing day showing that the data continues to be good from the US. Of course, it is unlikely that the DAX would be directly impacted by the employment data from the US but it has led to the general risk sentiment increasing around the world which should help feed the stock markets with bullish sentiment. On the other hand, the DAX should be limited by the highs of its range for now.

Looking ahead to the rest of the day, we do not have any major news from the Eurozone or Germany for the day and hence we should be seeing some bullish consolidation for the day but it remains to be seen whether the bullish sentiment would be maintained till the end of the day.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance