DaVita Inc. (DVA) Q1 2024 Earnings: Surpasses Revenue and EPS Estimates

Revenue: Reported at $3.071 billion for Q1 2024, surpassing the estimate of $3.028 billion.

Net Income: Achieved $240 million, significantly exceeding the estimated $179 million.

Earnings Per Share (EPS): Recorded at $2.65, outperforming the expected $1.95.

Operating Income: Reached $484 million with a margin of 15.8%, showing strong profitability improvements from previous periods.

Free Cash Flow: Reported a negative $327 million, indicating a sharp decline from the positive $265 million in the prior year.

Share Repurchases: Repurchased 2.1 million shares at an average price of $112.76, reflecting confidence in the company's value.

Operating Cash Flow: Negative $135 million, a significant drop from $463 million in the same quarter the previous year, impacted by increased days sales outstanding due to the Change Healthcare outage.

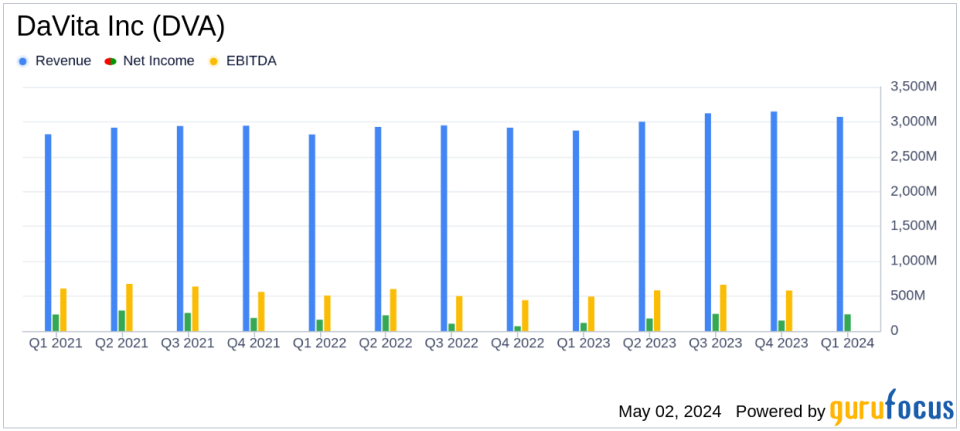

On May 2, 2024, DaVita Inc. (NYSE:DVA), a dominant force in the U.S. dialysis sector, disclosed its financial results for the first quarter ended March 31, 2024. The company released its 8-K filing, revealing a performance that exceeded analyst expectations on both top and bottom lines.

For the quarter, DaVita reported consolidated revenues of $3.071 billion, surpassing the estimated $3.027 billion. The company's diluted earnings per share (EPS) stood at $2.65, significantly higher than the anticipated $1.95. This performance underscores DaVita's robust operational efficiency and its ability to exceed market forecasts.

DaVita Inc., headquartered in Denver, Colorado, is the largest provider of dialysis services in the United States, controlling over 35% of the market share by both patients and clinics. The company operates more than 3,000 facilities worldwide and treats over 240,000 patients annually. A significant portion of DaVita's U.S. revenue comes from government payers, primarily Medicare, with commercial insurers contributing nearly all of the U.S. dialysis business profits despite representing only about 10% of U.S. patients treated.

Operational Highlights and Financial Metrics

The first quarter of 2024 saw DaVita achieve an operating income of $484 million with an adjusted operating income of $463 million. However, the company faced challenges with a negative operating cash flow of $(135) million and a substantial free cash flow deficit of $(327) million. These figures reflect some operational strains, notably impacted by delays in claims processing due to the Change Healthcare outage, which also led to increased outstanding borrowings under the company's revolving credit facility.

Despite these challenges, DaVita's management has demonstrated adeptness in navigating operational hurdles, as evidenced by the repurchase of 2.1 million shares at an average price of $112.76 per share, indicating confidence in the company's value proposition and future prospects.

Analysis of Dialysis Services and Patient Care

DaVita's U.S. dialysis treatments for the quarter numbered 7,151,512, a slight decrease from the previous quarter. Revenue per treatment saw a minor decline, which was offset by improvements in Medicare base rates and other annual rate increases. Patient care costs per treatment decreased, benefiting from lower health benefit expenses and other cost reductions, though partially offset by increased compensation expenses.

General and administrative expenses decreased due to lower purchased services and health benefit expenses, showcasing effective cost management strategies despite ongoing economic pressures.

Strategic Moves and Market Outlook

DaVita continues to adapt its strategy, focusing on optimizing outpatient clinic capacity and increasing the proportion of home dialysis patients. This strategic pivot is part of a broader industry trend towards more personalized and cost-effective care solutions.

The company's integrated kidney care (IKC) segment shows promising growth, with approximately 68,600 patients in risk-based care arrangements, representing about $5.3 billion in annualized medical spend. This segment is crucial as it aligns with industry shifts towards value-based care models.

Investor and Analyst Perspectives

Investors and analysts might be particularly interested in DaVita's ability to manage its debt and leverage amidst these operational challenges. The company's strategic review and adjustments in response to market conditions and regulatory environments will be critical in maintaining its leading position in the dialysis market.

DaVita's performance in Q1 2024 not only demonstrates resilience but also highlights its potential to sustain profitability and growth in a complex healthcare landscape. As the company continues to navigate through operational and economic challenges, its focus on innovation and clinical excellence will be pivotal in driving long-term shareholder value.

For further details, DaVita Inc. will be holding a conference call to discuss the Q1 results on May 2, 2024, providing an opportunity for investors and analysts to gain deeper insights into the company's strategies and financial health.

Explore the complete 8-K earnings release (here) from DaVita Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance