DaVita (DVA) Earnings Beat, Revenues Miss Estimates in Q2

DaVita Inc. DVA reported second-quarter 2019 adjusted earnings per share (EPS) of $1.22, beating the Zacks Consensus Estimate of $1.10. The figure rose 16.2% on a year-over-year basis.

Total revenues in the quarter declined 1.5% year over year to $2.84 billion, missing the Zacks Consensus Estimate of $2.85 billion.

Second-quarter adjusted operating income totaled $462 million, up 5.5% year over year.

Segment Details

This Zacks Rank #1 (Strong Buy) company reports through two main segments — Net dialysis and related lab patient service revenues and Other revenues.

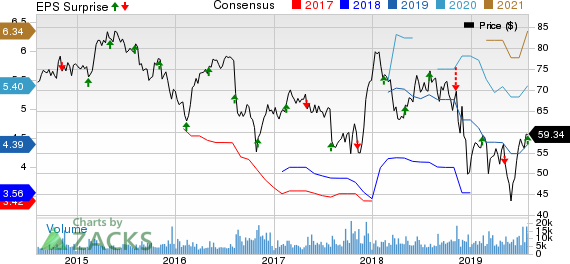

DaVita Inc. Price, Consensus and EPS Surprise

DaVita Inc. price-consensus-eps-surprise-chart | DaVita Inc. Quote

Net dialysis and related lab patient service revenues in the second quarter totaled $2.63 billion, up 1.9% on a year-over-year basis. Other revenues were $6 million, up 20% from the year-ago quarter’s figure.

Per management, total U.S. dialysis treatments for the second quarter were 7,520,587, or an average of 96,418 treatments per day, representing a per day increase of 2.6% year over year.

Moreover, the company provided dialysis services at 2, 2,971 outpatient dialysis centers, of which 2, 2,723 centers were located in the United States and 248 in nine countries outside the United States.

The company has also gained from calcimimetics. In the quarter under review, DaVita generated operating income of approximately $40 million from calcimimetics.

For investors’ notice, the company has completed the divestment of the DaVita Medical Group (“DMG”) division to Optum, a subsidiary of UnitedHealth Group UNH for a deal value of $4.34 billion.

Financial Condition

DaVita exited the second quarter with operating cash flow of $574 million.

Guidance

DaVita issued an impressive guidance for 2019.

Notably, the company now expects adjusted operating income between $1.64 billion and $1.70 billion. This reflects a significant increase from the earlier projected range of $1.54 billion to $1.64 billion.

Our Take

DaVita ended the second quarter on a tepid note. Dialysis services in the United States saw a solid quarter. In fact, dialysis activities ramped up overseas in the quarter. Further, the company is on track to acquire more dialysis centers in the United States. These apart, DaVita has opened additional dialysis centers across the United States. Moreover, a win against the union-backed ballot in California is indicative of bright prospects. The recent divestment of the DMG unit to Optum is likely to clear the company’s debts. An impressive guidance for 2019 is an added positive.

On the flip side, DaVita’s quarterly revenues dropped year over year in the second quarter. The company’s Other business unit has also been seeing softness for a couple of quarters now.

Earnings of Other MedTech Majors at a Glance

Other top-ranked companies, which posted solid results this earnings season, are Stryker Corporation SYK and Baxter International Inc. BAX.

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Its revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%. The company currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Its revenues of $2.84 billion beat the Zacks Consensus Estimate of $2.79 billion by 1.9%. The company currently has a Zacks Rank #2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance