D.R. Horton's (DHI) Shares Up as Q2 Earnings Top Estimates

D.R. Horton, Inc. DHI reported mixed results in second-quarter fiscal 2020, wherein earnings topped the Zacks Consensus Estimate but revenues lagged the same. Shares of the company gained almost 10% in the pre-market trading session on Apr 28, given strong year-over-year earnings and revenue growth.

Its industry-leading market share, broad geographic footprint and affordable product offerings across multiple brands supported the growth. However, a drop in the demand for homes in late March on a year-over-year basis, owing to spread of the COVID-19 pandemic, somewhat impacted top-line growth.

The company witnessed increase in sales cancellations and decrease in orders to date in April compared with the prior-year period owing to the COVID-19 pandemic. Its net sales orders are approximately 11% lower year over year month to date in April. Its mortgage subsidiary — DHI Mortgage — has experienced lower pricing and gains on the sales of mortgage loans and servicing rights in late March and April due to disruption in secondary mortgage markets.

Uncertainties in business operations arising from the COVID-19 outbreak prompted D.R. Horton to withdraw its previously issued fiscal 2020 guidance.

Earnings & Revenue Discussion

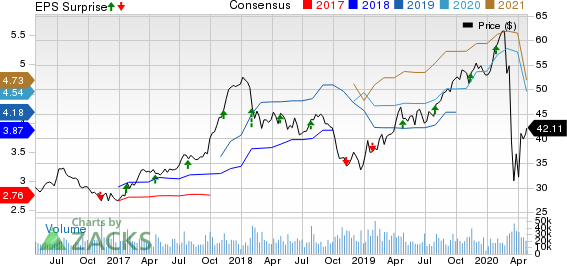

The company reported adjusted earnings of $1.30 per share in the quarter, surpassing the Zacks Consensus Estimate of $1.12 by 16.1% and increasing 39.8% from the year-ago period.

D.R. Horton, Inc. Price, Consensus and EPS Surprise

D.R. Horton, Inc. price-consensus-eps-surprise-chart | D.R. Horton, Inc. Quote

Total revenues (Homebuilding, Forestar and Financial Services) came in at $4.5 billion, up 9% year over year. However, the reported figure missed the consensus mark of $4.57 billion by 1.6%.

Home Closings and Orders

Homebuilding revenues of $4.38 billion increased 9.6% from the prior-year quarter. Home sales also increased 9.6% year over year to $4.36 billion, aided by higher home deliveries. However, land/lot sales and other revenues were $32.2 million, down from $46.6 million a year ago.

Home closings increased 8% from the prior-year quarter to 14,539 homes and 10% in value to $4.4 billion. It recorded growth across all regions comprising East, Midwest, Southeast, West and South Central, and Southwest.

Net sales orders in the quarter increased 20% year over year to 20,087 homes. It registered double-digit growth in all geographic regions served, except Southeast, which recorded 7% net sales order growth. Value of net orders also improved 22% year over year to $6 billion. The cancellation rate was 19%, unchanged from the prior-year quarter.

Order backlog of homes at the end of the quarter was 19,328 homes, up 14% year over year. The value of backlogs was also up 18% from the prior year to $5.9 billion.

Revenues from the Financial Services segment increased 2.9% from the year-ago level to $104.5 million.

Forestar contributed $159.1 million to its total quarterly revenues, reflecting a notable improvement from $65.4 million a year ago.

Margins

The company’s consolidated pre-tax margin expanded 260 basis points to 13.8% in the quarter.

Balance Sheet Details

D.R. Horton’s cash, cash equivalents and restricted cash totaled $1.52 billion as of Mar 31, 2020 compared with $1.49 billion at fiscal 2019-end.

At the end of the reported quarter, it had $1 billion of unrestricted homebuilding cash and $1 billion of available capacity on the $1.6-billion revolving credit facility. Total homebuilding liquidity was $2 billion.

As of Mar 31, 2020, homebuilding debt totaled $2.5 billion, with $400 million of senior note maturities in the next 12 months.

In the first half of fiscal 2020, cash used in operations was $395.1 million compared with 461.7 million in the corresponding year-ago period.

At the end of the fiscal second quarter, the company had 33,400 homes in inventory, of which 16,700 were unsold. It had 329,300 lots remaining, of which 36% were owned and 64% were controlled through land purchase contracts.

As of Mar 31, 2020, its homebuilding debt to total capital was 19.2%. Its trailing 12-month return on equity was 19.1%.

It repurchased 4 million shares of common stock for $197.3 million during second-quarter fiscal 2020. The company’s remaining stock repurchase authorization — which has no expiration date — as of Mar 31, 2020 was $535.3 million.

Zacks Rank

Currently, D.R. Horton carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Lennar Corporation LEN reported solid results in first-quarter fiscal 2020 (ended Feb 29, 2020). This marks the company’s fourth consecutive quarter of an earnings beat. The results mainly benefited from solid demand for new homes, depicting healthy housing market fundamentals.

KB Home KBH reported impressive results in first-quarter fiscal 2020 (ended Feb 29, 2020). Earnings and revenues topped the respective Zacks Consensus Estimate, and registered notable improvement on a year-over-year basis.

PulteGroup Inc. PHM reported first-quarter 2020 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues lagged the same. Higher demand owing to favorable housing dynamics in most part of the quarter, backed by lower interest rates and improved affordability, had a positive impact on PulteGroup’s performance.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance