Crypto Derivatives Traders Bet on Ether Staking Yields Doubling to 8% Post-Merge

The major Ethereum overhaul known as the Merge looks poised to make staking the blockchain's ether (ETH) tokens more rewarding than ever.

That's the message from derivatives traders, anyhow. Yields are seen jumping to 8% from around 4% now, according to interest-rate swap pricing on the Voltz Protocol. The Merge is likely to happen soon, with Ethereum's backers eyeing September for the event. Ether prices have surged in recent weeks in anticipation, and higher yields would further enrich the ether ecosystem.

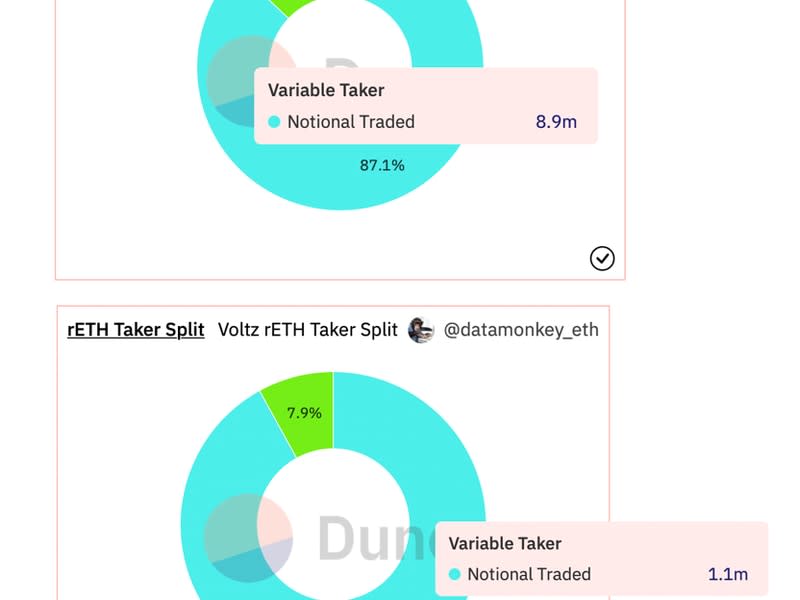

Investors can bet on future yields for Lido's staked ether (stETH) token and Rocket's rETH through Voltz. At press time, most traders on those two pools were what's known as variable takers (VTs), meaning they're swapping a fixed interest rate for a variable rate, believing staking yields will double to 8%. About 82% of the just over $12 million in those pools, which went live July 1 and will expire at the end of December, are VT investments.

"With so many traders choosing to be VTs, this suggests the vast majority are expecting variable rates [staking yields] to increase substantially from where they are today," Simon Jones, Voltz CEO and co-founder, told CoinDesk.

The emergence of the decentralized finance (DeFi) interest rate swap market may help accelerate market maturity by allowing borrowers and lenders to hedge risks and facilitate price discovery of interest rates. It's yet one more way cryptocurrencies are looking more like traditional financial markets.

The two-month-old Voltz protocol allows traders to create a market for any variable rate of return. Traders in stETH and rETH pools can swap fixed for variable return and variable for fixed return with leverage merely by depositing ether as margin. Traders do not need to hold stETH or rETH to enter the trade.

Voltz's swap market is analogous to the traditional interest rate market, where two counterparties agree to exchange one stream of future interest payments for another. A common TradFi strategy is exchanging a fixed interest rate for a floating rate, often traded against an industry benchmark interest rate, such as the London Interbank Offered Rate (LIBOR).

Variable takers can earn a 150% annual percentage yield by taking a levered bet through stETH pools, Jones told CoinDesk earlier this month.

"If the stETH rate is higher through the pool's term than the fixed rate at the point of entering the pool, the trader will be in the money and will have successfully traded The Merge in one of the most capital efficient ways possible," the official explainer said.

The Merge will combine Ethereum's current proof-of-work chain with the proof-of-stake beacon chain that has been running since December 2020.

After the upgrade, ether's total new issuance will likely drop by 90%, bringing a store of value appeal to the cryptocurrency. Beacon Chain stakers currently earn block rewards. Post-Merge, stakers will get a share of transaction fees and revenue from what's known as miner extractable value (MEV), or ordering blockchain transactions in the way that generates the most money.

The upgrade has most market participants taking bullish exposure on ether in the spot and derivatives markets and buying stETH tokens. However, rates play may be a relatively safer option in the current macroeconomic environment.

Ether's price and the prices of its staked derivative tokens are vulnerable to the U.S. Federal Reserve's ongoing campaign of increasing interest rates. In other words, the Merge-driven upside in ether and related tokens could remain elusive due to Fed tightening. Staking yields, however, could continue to stay resilient and rise as expected after the Merge. The yield on staked ether has remained steady at around 4% throughout the recent bear market.

That said, leverage also brings with it the chance of forced liquidations due to margin shortages. Another source of risk is a potential drop in yields. "While leverage increases your potential upside, it also exposes you more on the downside, meaning you could get back less than you put in," Jones said.

Yahoo Finance

Yahoo Finance