Crude Oil Prices Torn Between Supply Trends, US Dollar Influence

DailyFX.com -

Talking Points:

Crude oil prices torn as US Dollar falls, swing supply expands further

Gold prices find support as geopolitics overshadows Fed rate hike bets

Day two of G20 foreign ministers’ meeting, rig count data eyed ahead

Crude oil prices continued to oscillate in a choppy range as traders weighed the conflicting influence of a weaker US Dollar – a source of support because the WTI benchmark is priced in terms of the greenback – and growing swing supply. US crude inventories and exports jumped to record highs last week, with the latter swelling by the most in almost three years.

Gold prices rose as the US Dollar and Treasury bond yields sank in tandem, boosting the appeal of non-interest-bearing and anti-fiat assets. The move seems to mark the triumph of geopolitical jitters over Fed rate hike speculation. The stock of news-flow shaping FOMC policy bets was sapped as Chair Yellen finished a second day of Congressional testimony, letting a G20 foreign ministers’ meeting capture the spotlight.

Looking ahead, a quiet economic data docket seems likely to keep politics at the forefront as the G20 meeting in Bonn continues. That may keep gold prices supported, though the absence of bombshell headlines by midday on Wall Street may see corrective flows take over and erase some of the moves seen since early Thursday. The Baker Hughes rigs count report is on tap on the oil side of the equation.

Are gold and crude oil prices matching DailyFX analysts’ first-quarter bets? Find out here!

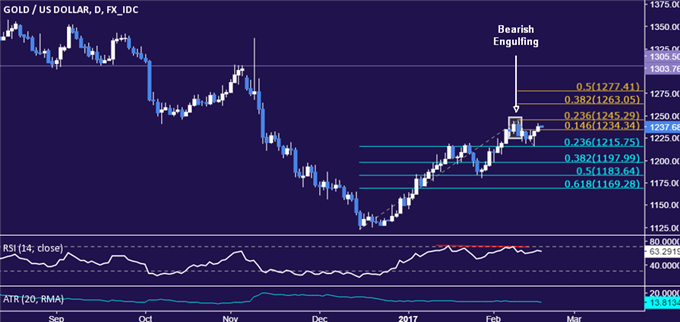

GOLD TECHNICAL ANALYSIS – Gold prices edged up to take aim at February’s swing high but a still-valid Bearish Engulfing candlestick pattern hints a top may yet be in the works. A daily close above the 23.6% Fibonacci expansion at 1245.29 exposes the 38.2% level at 1263.05. Alternatively, move back below the 14.6% Fib at 1234.34 targets the 23.6% Fib retracement at 1215.75.

Chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS – Crude oil price standstill continues. A daily close above range resistance at 53.86 paves the way for a test of the 55.21-65 area (January 3 high, 38.2% Fibonacci expansion). Alternatively, a turn below rising trend line support, now at 51.92, sees the next downside barrier at 50.25, the 38.2% Fib retracement.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance