Crude Oil Price Update – Trader Reaction to $24.50 Will Set the Tone on Wednesday

U.S. West Texas Intermediate crude oil futures are trading slightly higher on Wednesday, but off their high, suggesting traders aren’t too impressed with the announcement of an agreement on the $2 trillion stimulus bill which is expected to be passed through Congress later on Wednesday.

Traders probably showed little reaction to the news since the major issue remains the deterioration of global demand. “Demand continues to deteriorate as more countries impose shutdowns and stricter travel restrictions,” ING analysts said in a note.

At 10:20 GMT, May WTI crude oil is trading $24.03, up $0.02 or +0.08%.

Daily Technical Analysis

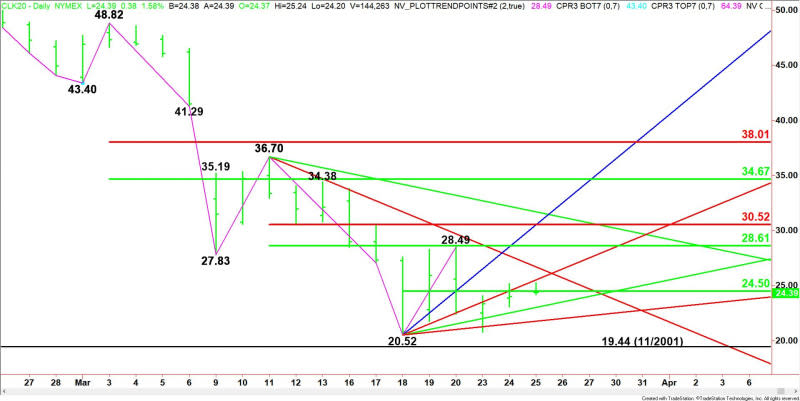

The main trend is down according to the daily swing chart. A trade through $20.52 will signal a resumption of the downtrend. A move through $36.70 will change the main trend to up. This is highly unlikely today unless Russia and Saudi Arabia end their price war.

The minor range is $20.52 to $28.49. Its 50% level or pivot at $24.50 is likely to control the direction of the market on Wednesday.

The short-term range is $36.70 to $20.52. Its retracement zone at $28.61 to $30.52 is the primary upside target.

Daily Technical Forecast

Based on the early price action and the current price at $24.03, the direction of the May WTI crude oil market on Wednesday is likely to be determined by trader reaction to the pivot at $24.50.

Bearish Scenario

A sustained move under $24.50 will indicate the presence of sellers. This could trigger a break into a pair of uptrending Gann angles at $23.02 and $21.77. The latter is the last potential support angle before the $20.52 main bottom.

The next major downside target is the November 2001 bottom at $19.44. If this price fails, it’s anyone’s guess where the selling will stop with some experts calling for $10 crude at some point this year.

Bullish Scenario

A sustained move over $24.50 will signal the presence of buyers. Overtaking the uptrending Gann angle at $25.52 will indicate the buying is getting stronger with the next target angle coming in at $26.70.

Overtaking $26.70 will indicate the buying is getting stronger with $28.49 to $28.61 the next likely target area.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/JPY Price Forecast – US Dollar Continues to Power Higher

AUD/USD Price Forecast – Australian Dollar Struggling At Major Round Figure

Lockdown and Economic Stability – Impact of the Coronavirus on the World’s Economy Today

Crude Oil Price Update – Trader Reaction to $24.50 Will Set the Tone on Wednesday

EUR/USD Daily Forecast – Upside Potential Rises as Dollar Demand is Expected to Fade

Yahoo Finance

Yahoo Finance