Crude Oil Price Update – Bullish Over $62.15, Bearish Under $61.18

April West Texas Intermediate crude oil futures posted a one-week high on Friday, supported by another strong performance by global equity markets and a weaker U.S. Dollar which slipped to a three-year low. Gains were limited, however, by worries over rising U.S. production.

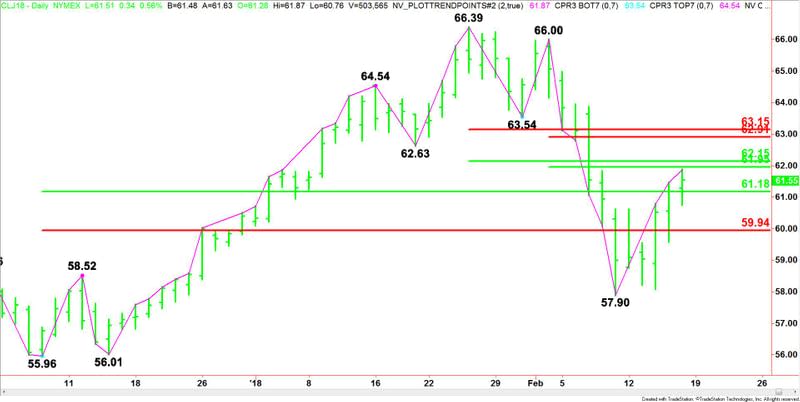

Daily Technical Analysis

The main trend is down according to the daily swing chart. The five day rally suggests momentum may be shifting to the upside, however, the market is still only testing retracement zones.

The trend will turn up on a move through $66.00. The downtrend will resume when $57.90 is taken out.

The main range is $55.96 to $66.39. Its retracement zone is $61.18 to $59.94. Closing on the strong side of this zone is helping to generate an upside bias.

The intermediate range is $66.39 to $57.90. Its retracement zone is $62.15 to $63.15. This zone is one upside target.

The short-term range is $66.00 to $57.90. Its retracement zone target is $61.95 to $62.91. This zone is the second upside target.

Combining the two retracement zones creates potential resistance clusters at $61.95 to $62.15 and $62.91 to $63.15.

Since the main trend is down, sellers are likely to come in on a test of these areas.

Daily Technical Forecast

Based on Friday’s close at $61.55, we’re looking for the upside bias to continue on a sustained move over $62.15 and for weakness to re-emerge on a sustained move under $61.18.

Any rally is likely to be labored until the buying is strong enough to overtake $63.15. The way of least resistance is down since the support levels are spread wider apart.

This article was originally posted on FX Empire

More From FXEMPIRE:

Crude Oil Price Update – Bullish Over $62.15, Bearish Under $61.18

AUD/USD Forex Technical Analysis – Trend Down, Momentum May Have Shifted to Downside

S&P 500 Price forecast for the week of February 19, 2018, Technical Analysis

Bitcoin Price forecast for the week of February 19, 2018, Technical Analysis

FTSE 100 Price forecast for the week of February 19, 2018, Technical Analysis

Yahoo Finance

Yahoo Finance