Crude Oil Forecast for the Week of January 22, 2018, Technical Analysis

WTI Crude Oil

The WTI Crude Oil market pulled back significantly during the week, especially considering that we have been so bullish as of late, and this pullback flies in the face of the trend. I think this is the market trying to build up enough momentum to finally break above the $65 level, and at this point I think that a short-term pullback makes sense. I think that the $60 level underneath will be a bit of a “floor”, and that gives us an opportunity to buy oil cheaply. I’m looking for supportive candles, as it gives us an opportunity to take advantage of value that I think will present itself again. The US dollar looks as if it is going to rally in the short term, so that might be one of the catalysts.

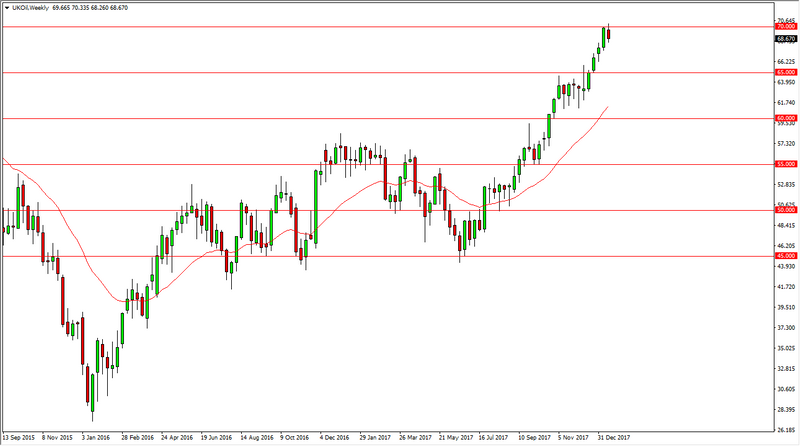

Brent

Brent markets try to break above the $70 level during the week, but then rolled over to show signs of exhaustion. It looks like we may pull back a little further, but quite frankly just as in the WTI Crude Oil market, it is a healthy diversion. I think that the $65 level underneath is going to be massively supportive, and essentially a “floor” in the market. I don’t like shorting this market, least not until we break significantly down below there. Ultimately, I think that the bullish pressure is something that you should pay attention to, but you should also recognize that momentum cannot go on forever. This pullback offers value if you are cautious enough and more importantly: patient enough.

WTI Video 22.01.18

This article was originally posted on FX Empire

More From FXEMPIRE:

S&P 500 Price Forecast for the Week of January 22, 2018, Technical Analysis

AUD/USD Forex Technical Analysis – Reversal Top at .8038 May Provide Short-Term Resistance

BTC/USD Price forecast for the week of January 22, 2018, Technical Analysis

ETH/USD Price forecast for the week of January 22, 2018, Technical Analysis

Uncertainty Over U.S. Government Shutdown May Fuel Flight-to-Safety Moves

Yahoo Finance

Yahoo Finance