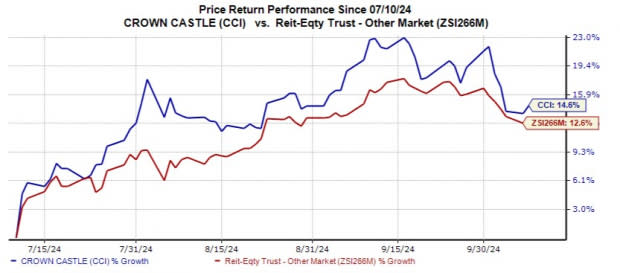

Crown Castle Stock Up 14.6% in Three Months: Will It Rise Further?

Shares of Crown Castle Inc. CCI have rallied 14.6% over the past three months, outperforming the industry's upside of 12.6%.

Crown Castle is well-poised to gain from the rising wireless data consumption that is expected to increase significantly over the next few years with the deployment of 5G networks. The company’s long-term leases, with its solid and creditworthy tenant base, assure steady revenues. A healthy balance sheet position will likely support its growth endeavors.

Analysts seem bullish on this tower real estate investment trust (REIT), carrying a Zacks Rank #2 (Buy), with the Zacks Consensus Estimate for its 2024 funds from operations (FFO) per share being raised marginally northward over the past three months to $6.97.

Image Source: Zacks Investment Research

Factors Behind CCI Stock Price Surge: Will the Trend Last?

The wireless data consumption is expected to increase considerably over the next several years, driven by the advent of next-generation technologies, including edge computing functionality, autonomous vehicle networks and the Internet of Things, the rampant usage of network-intensive applications for video conferencing and cloud services, and hybrid-working scenarios. Given Crown Castle’s unmatched portfolio of more than 40,000 towers in each of the top 100 basic trading areas of the United States and approximately 90,000 route miles of fiber (as of the second quarter of 2024), it remains well-positioned to capitalize on this upbeat trend.

CCI’s investments in fiber and small cell business on the back of acquisitions, constructions and new deployments, complement its tower business and offer meaningful upside potential to its 5G growth strategy. Management remains on track to deliver 2024 organic revenue growth of 4.5% in towers, 2% in fiber solutions and double digits in small cells. The company expects 11,000 to 13,000 new billable nodes in 2024 compared to 8,000 nodes in 2023.

CCI has long-term tower lease agreements with top U.S. carriers, which contribute to recurring site rental cash flows over the long term. The wireless tenant contracts have an initial term of five to 15 years with contractual escalators and multiple renewal periods of five to 10 years each, which the tenant can exercise at their discretion. The initial term for the fiber solutions tenant contracts varies between three to 20 years.

Such long-term leases enable the company to enjoy recurring revenues that provide top-line stability, while contracted rent escalators on the majority of its revenues offer embedded growth. Moreover, a strong and creditworthy tenant base adds resiliency to its business.

CCI has sufficient liquidity and a decent balance sheet position. The company exited the second quarter of 2024 with cash and cash equivalents of $155 million. As of June 30, 2024, the net debt to last quarter's annualized adjusted EBITDA was 5.9x. It has only 8% of its debt maturing through 2025 and its weighted average term to maturity is seven years. The healthy balance sheet position facilitates access to debt markets on attractive terms.

Solid dividend payouts are the biggest enticement for REIT shareholders and Crown Castle is committed to that. It has increased its dividend four times in the last five years and its five-year annualized dividend growth rate is 6.91%. Given that the company’s dividends are supported by high-quality, long-term contracted lease payments, and it benefits from being a provider of mission-critical shared communication infrastructure assets, we expect the dividend payout to be sustainable over the long run.

Key Risks for CCI Stock

Customer concentration is very high for Crown Castle. As of June 30, 2024, around three-fourths of the company’s site rental revenues were derived from T-Mobile (35%), Verizon (19%) and AT&T (20%). Loss of any of these customers or consolidation among them will significantly affect the company’s top line.

The evolution of new technologies may reduce the demand for site leases. Further, the recent developments of satellite-delivered radio and video services will weigh on the need for tower-based broadcast transmission. In addition, frequent changes in demand for network services will tend to increase volatility in Crown Castle’s revenues.

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are Iron Mountain IRM and Welltower WELL, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Iron Mountain’s 2024 FFO per share is pegged at $4.49, up 8.98% year over year.

The Zacks Consensus Estimate for Welltower’s 2024 FFO per share is pegged at $4.19, up 15.11% year over year.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Crown Castle Inc. (CCI) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance