CrowdStrike (CRWD) Adds New Feature to Falcon Cloud Platform

CrowdStrike CRWD has upgraded its Falcon Cloud Security platform with a new cybersecurity feature — 1-Click XDR. The company claims that the newly added feature will help organizations more effectively protect their cloud environments from cyber threats.

Per CrowdStrike, the 1-Click XDR feature automatically detects and safeguards unprotected cloud workloads by promptly deploying the CrowdStrike Falcon agent. CrowdStrike Falcon is a cloud-managed security platform that provides real-time as well as historical event data, which is required to identify, understand and respond to cyber-attacks.

The Falcon platform uses software, which CrowdStrike describes as an agent, to sense cybersecurity threats. However, the newly introduced 1-Click XDR comes with an Agentless Snapshot Scanning feature, which provides organizations with full visibility into cloud workload risks by detecting vulnerabilities and installed applications, even if an agent can’t be installed.

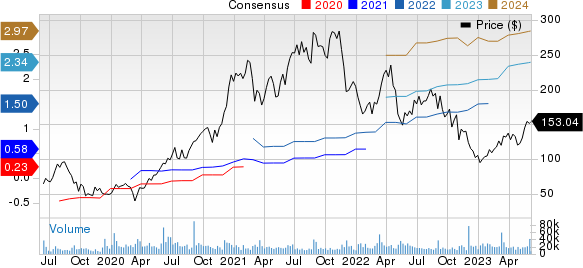

CrowdStrike Price and Consensus

CrowdStrike price-consensus-chart | CrowdStrike Quote

The CrowdStrike Falcon platform with the 1-Click XDR capability will provide customers with a unified view of the attack path used by hackers without the complexity of multiple consoles and agents.

CrowdStrike’s sustained focus on enhancing its product capabilities is helping it win new customers. Moreover, CRWD is benefiting from the rising demand for cyber-security solutions due to the slew of data breaches and the increasing necessity for security and networking products amid the growing hybrid working trend. The continued digital transformation and cloud-migration strategies adopted by organizations are key growth drivers.

Going by the Grand View Research report, the global cybersecurity market is projected to witness a CAGR of 12.3% during the 2023-2030 period. These predictions bode well for CRWD, which has a diversified product portfolio for large and mid-sized organizations to protect their sensitive data.

CrowdStrike has been witnessing top-and-bottom-line growth for the past several quarters due to the strong demand environment for cyber-security solutions and its sustained focus on enhancing product offerings through in-house research and development and acquisitions.

In the most recently reported financial results for the first quarter of fiscal 2024, the company’s revenues and non-GAAP earnings surged 42% and 83.9%, respectively, on a year-over-year basis. In fiscal 2023, CRWD’s revenues jumped 54.4% year over year to $2.24 billion, while non-GAAP earnings surged 130% to $1.54 per share.

Zacks Rank & Stocks to Consider

CrowdStrike currently carries a Zacks Rank #3 (Hold). Shares of CRWD have rallied 45.3% year to date (YTD).

Some better-ranked stocks from the broader technology sector are Meta Platforms META, Manhattan Associates MANH and Blackbaud BLKB, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta's second-quarter 2023 earnings has been revised 2 cents southward to $2.85 per share in the past seven days. For 2023, earnings estimates have been revised 2.4% upward to $12.04 per share in the past 30 days.

Meta’s earnings beat the Zacks Consensus Estimate twice in the preceding four quarters while missing the same on two occasions, the average surprise being 15.5%. Shares of META have surged 125.3% YTD.

The Zacks Consensus Estimate for Manhattan Associates' second-quarter 2023 earnings has been revised upward by a couple of cents to 72 cents per share for the past 60 days. For 2023, earnings estimates have moved upward by 17 cents to $2.87 per share in the past 60 days.

Manhattan Associates' earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 33.6%. Shares of MANH have soared 52.1% YTD.

The Zacks Consensus Estimate for Blackbaud’s second-quarter 2023 earnings has been revised 2 cents northward to 93 cents per share in the past 30 days. For 2023, earnings estimates have increased to $3.75 per share from $3.68 30 days ago.

Blackbaud's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 10.4%. Shares of BLKB have rallied 25.2% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance