Why the crash in software stocks isn't over

Sing it out loud if you are an investor in thought-to-be hot software stocks: it has only just begun.

With Wall Street more closely scrutinizing valuations on tech companies with no — or little profits —after several high profile IPO disasters (see WeWork), the software space has been hammered this month. The Invesco Dynamic Software ETF —which reflects the performance of 30 U.S. software stocks such as Zoom Video Communications —has dropped 3% in October. The Nasdaq Composite and S&P 500 are up 1.5% and 1%, respectively, during that same stretch.

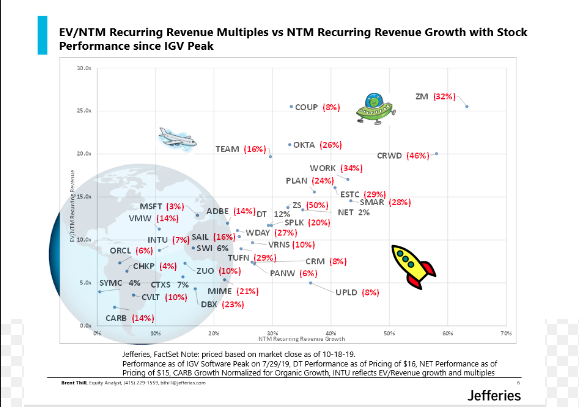

Investment bank Jefferies points to software stocks being viewed right now as having “unsustainable” valuations. To that end, the month-to-date selloffs in several high profile names has been somewhat shocking.

CrowdStrike (CRWD): -17%

Zoom Video Communications (ZM): -14%

Workday (WDAY): -9%

Slack Technologies (WORK): -5%

Note that CrowdStrike, Workday and Slack Technologies all fall into the camp of being unprofitable software companies. Hence, the punishment is raining down on them the most relative to, say, a Salesforce (CRM) (down 2% this month).

Unfortunately, for those traders in these momentum names that have been caught off guard by the downdraft, the selling is unlikely over yet. The simple reason, Jefferies points to, is that software valuations remain out of whack with what’s probable on the earnings front in the year ahead. Think no profits, or guidance from management teams that suggest otherwise.

Moreover, software valuations continue to trade higher than what some of the companies in the space would be valued at in a takeover.

Historically, software companies have traded within a band from a two-times to 12-times enterprise value to revenue multiple, per Jefferies research. While the lower end of this band has remained steady for software stocks, the higher end has pushed to a 20-times enterprise to revenue multiple.

“Even historic terminal M&A takeout multiples do not support these valuations (CRM acquired MULE for 16x EV/NTM revs., CRM acquired DATA for 11x, and SAP acquired for Qualtrics for 17x). As such, we believe current valuation multiples for the high growth names are unsustainable and we expect that the correction will continue,” writes Jefferies.

The way to play software in Jefferies mind? Stay clear of momentum, and dive into a solid grower that pays a dividend such as Microsoft.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read the latest financial and business news from Yahoo Finance

SmileDirect co-founder: here’s what life will look like post IPO

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance