Could OneWeb help solve Britain’s rural broadband problems?

Streaks of light from fast-moving internet satellites have become a common sight in Britain's night skies this summer.

These low-earth-orbit (LEO) satellites, 1,000km above the Earth’s surface, are designed to beam internet from space, providing connectivity to rural areas that may otherwise have been left behind.

One company that had been hoping to provide such a service was OneWeb, which went bankrupt in March after its biggest investors pulled out amid the coronavirus crisis.

Today, Britain will enter into a bidding war for OneWeb, which will see the Government take a 20pc stake in the company for $500m (£406m).

Britain hopes its satellites could form a back up to modern GPS and give the UK some sovereign satellite navigation capacity. These positional satellites are seen as an answer to Britain being kicked out of Europe’s Galileo project.

But OneWeb’s satellites could offer other uses too. The original aim of the network was to provide global linked-up broadband coverage with 650 satellites weighing under 250kg. It has so far put up 74.

Amid its bankruptcy, the company has also stepped up its claims that it could provide faster broadband and 5G coverage from its satellites as well as offering backhaul, essentially backup capacity, to mobile networks.

All this could, in theory, help improve Britain’s telecoms resilience and even reduce our reliance on Huawei in some remote locations. While OneWeb has been eagerly promoted as offering a GPS rival, according to a report by the Satellites Catapult, which has lobbied in favour of rescuing OneWeb, satellites could help connect 60,000 homes in internet not-spots.

The report said: “Another important opportunity that OneWeb provides is, finally, to be able to offer superfast broadband to every UK household” while also “[providing] full 5G capability to those and many more households by 2025”. It added: “No UK citizen need ever feel digitally excluded again.”

But will these bold claims work, and how reliable is satellite technology for providing broadband?

Despite its collapse into bankruptcy on March 27, OneWeb has stepped up its ambitions in 5G and broadband.

In late May, it submitted a request to the US communications regulator for plans to launch up to 48,000 satellites. Boss Adrian Steckel, the Texan telecoms veteran who remains chief executive amid its bankruptcy, said: “We have always believed LEO satellites must be part of a converged broadband network.”

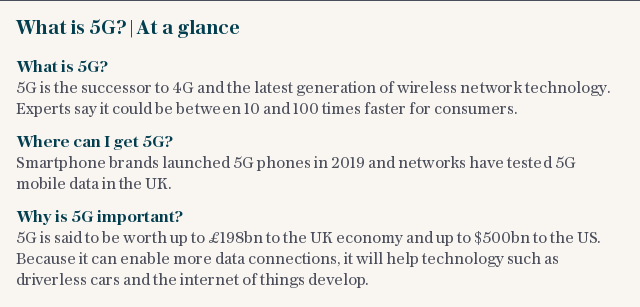

In the US, this has seen the Federal Communications Commission promising nearly $10bn in incentive payments to satellite makers as part of its 5G rural broadband auction, which, according to Morgan Stanley, could provide a $100bn opportunity by 2040.

Low-earth-orbit satellites are seen as being able to provide these “fibre-like” speeds because they are a lot lower than regular satellites, which are 35,000km above earth.

But despite being lower, the technology is not as simple as 5G beaming straight to a phone or broadband directly to a home router. Modern satellite phones are bulky and expensive and designed for remote environments like oil rigs or the Arctic.

“We have been talking about using this technology in hard to reach places for 15 years,” says Matthew Howett. “It’s the final 1 to 2pc.”

Satellite use for consumers would still rely on terminals on the ground. A rural home, for instance, could be connected to the satellites using a consumer antenna, rather than a fibre cable dug through miles of road. A satellite network would only prove efficient in these rural locations, rather than say in a town or city with its own cable and mobile network.

Although costs of satellites have come down, launching rockets is still not a cheap enterprise. Meanwhile, latency, the speed at which broadband signals travel back and forth, is an unsolved problem. Howett says: “The biggest barriers are cost and latency.”

OneWeb says its technology will soon be fit for 5G speeds. In tests in South Korea last year, broadband speeds using its low orbit satellites achieved 400Mbps and a latency of 32 milliseconds. Not quite as fast as ground networks, but the margin has shrunk. For regular rural broadband, however, it would plug a gap.

Stuart Martin, chief executive of the Government backed Satellite Applications Catapult, is a big believer that OneWeb holds the key to connecting the digitally excluded.

“[OneWeb] offers us genuine ubiquitous communications of high-speed broadband and 5G anywhere in the world,” he says. “It is complementary [to cable networks]. It is best suited to those areas that are not going to get access to fibre broadband or 5G just because the economics do not work.”

However, the company is not alone in developing this technology. SpaceX, a satellite venture led by Elon Musk, is arguably further ahead with hundreds of satellites in orbit. Amazon is also trying its hand at a broadband constellation. As Chris Quilty, a space analyst and president of Quilty Analytics, notes: “Picking a head-to-head fight with Amazon and SpaceX is not a battle I would want to fight.”

And even Musk, who is OneWeb's main rival with Starlink, is not wholly confident the technology is economically competitive. “It’s really important to set the stage here for LEO communications constellations,” Musk told a conference earlier this year. “Guess how many LEO constellations didn’t go bankrupt? Zero.”

On Thursday, Britain will put up $500m for a 20pc stake in OneWeb. Major financiers, including Indian billionaire Sunil Mittal’s Bharti Enterprises, are backing the UK offer.

Although the satellites may offer a lifeline for those stuck in a not-spot, success in this corner of the space race is far from guaranteed.

Yahoo Finance

Yahoo Finance