If you could handle the insanity, Tesla was the best auto stock to invest in for 2018

Tesla and Elon Musk took us on a wild ride in 2018 - but the stock is still the best performer in the US auto sector.

Tesla has surged at the end of 2018, becoming the only auto stock I cover that's in positive territory, beating out the S&P 500 index and GM, Ford, FCA, and Ferrari.

If you could handle the heat, Tesla was a good investment in 2018.

Tesla CEO Elon Musk is no stranger to talking down Tesla's stock, but in 2018, he seemed to do everything in his power to both send it south and propel it into orbit. He behaved badly on Twitter - stock slid! He unveiled a go-private scheme, again on Twitter, calling for a $US420-per-share price - stock surged!

Always volatile, Tesla shares in 2018 entered a new realm of lurching unpredictability. And now that the end of the year is upon us, we can add up the damage and discover that ... Tesla was 2018's best investment in the auto sector, among the stocks that I track at Business Insider.

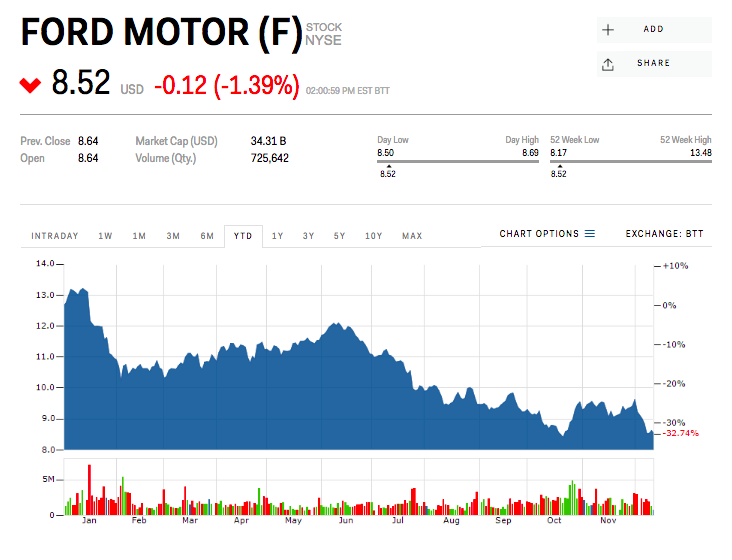

Yes, it could all go completely to hell in the next few weeks. But for now, Tesla shares are above $US370, up 16% year-to-date. General Motors, Ford, Fiat Chrysler Automobiles, and Ferrari are all in the red, with Ford down over 30%. Only Ferrari is close, with its stock having slipped just 1%.

Since 2010, when Tesla staged an IPO, shares are up 1,300%, so early investors have certainly been copiously rewarded. But if you could somehow have stayed the course in 2018 - through what the nuttiest, most harrowing narrative I've seen in the auto industry since the near-simultaneous bankruptcies of GM and Chrysler in 2009 - you would have beaten the S&P 500 index by close to 20%.

Tesla - the ultimate defensive stock!

Tesla could have room to run in 2019

So, are Tesla shares tapped out? Well, consider that a profitable third quarter could be followed by a profitable fourth. At which point, having more than 20% of Tesla's available shares making up various short positions means you have a scenario in which early 2019 brings a wave of short covering and a substantial move north for the stock.

If Tesla can threaten $US400 per share before 2018 comes to a close, there isn't much in the way of prospective negative news ahead of Q4 2018 earnings being reported - and 2019 looks to be a year in which Tesla could make several market-moving announcements on the product front, starting with an unveiling of the Model 3 crossover in the first or second quarter.

So why has Tesla seemingly brushed off an epic amount of bad news in 2018?

It's the revenue, stupid. Tesla and Musk were a hot mess for the entire year, but in the end, the company has built and sold thousands more vehicles than it did in 2017. That translated into nearly $US7 billion sloshing in for Q3, a record. Keep that up, control your costs, and Tesla neatly reverses from almost a decade of losses to a future of gains.

Plus, people love the product. They love it so much that they're willing to put up with Tesla's growing pains as a manufacturing enterprise. That might not last forever, but at the moment, if you want to invest in a pure electric-car play, Tesla is your only real choice.

Every year, I like to summarize the stock-market performance of the automakers I follow most closely. Here's this year's tale of the tape (as of the weekend of December 15), with Tesla coming out on top:

Yahoo Finance

Yahoo Finance