Could Calima Energy Limited’s (ASX:CE1) Investor Composition Impacts Your Returns?

The big shareholder groups in Calima Energy Limited (ASX:CE1) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, ‘Don’t tell me what you think, tell me what you have in your portfolio.’

Calima Energy is not a large company by global standards. It has a market capitalization of AU$55.6m, which means it wouldn’t have the attention of many institutional investors. Taking a look at the our data on the ownership groups (below), it’s seems that institutions own shares in the company. Let’s delve deeper into each type of owner, to discover more about CE1.

Check out our latest analysis for Calima Energy

What Does The Institutional Ownership Tell Us About Calima Energy?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

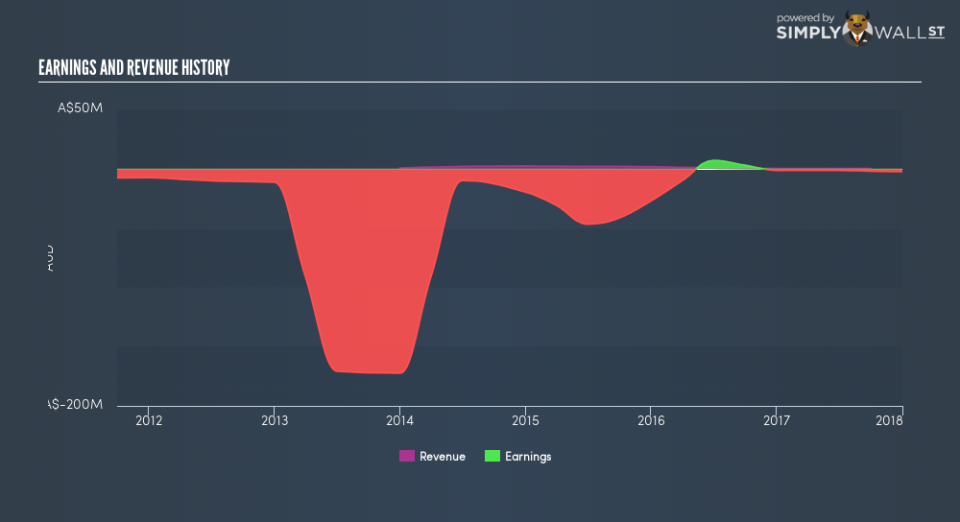

As you can see, institutional investors own 8.5% of Calima Energy. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Calima Energy’s earnings history, below. Of course, the future is what really matters.

Hedge funds don’t have many shares in Calima Energy. As far I can tell there isn’t analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Calima Energy

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Calima Energy Limited. Insiders have a AU$20.8m stake in this AU$55.6m business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public holds a 48.0% stake in CE1. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 6.1%, of the shares on issue. It’s hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance