Could AUB Group Limited (ASX:AUB) Have The Makings Of Another Dividend Aristocrat?

Is AUB Group Limited (ASX:AUB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

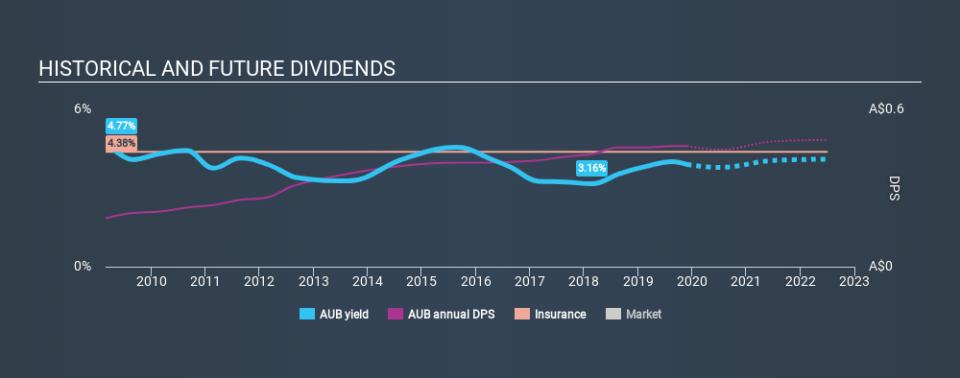

In this case, AUB Group likely looks attractive to investors, given its 3.9% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can reduce the risk of holding AUB Group for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on AUB Group!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. AUB Group paid out 66% of its profit as dividends, over the trailing twelve month period. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

We update our data on AUB Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of AUB Group's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was AU$0.18 in 2009, compared to AU$0.46 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.5% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. AUB Group has grown its earnings per share at 3.5% per annum over the past five years. Growth of 3.5% is relatively anaemic growth, which we wonder about. If the company is struggling to grow, perhaps that's why it elects to pay out more than half of its earnings to shareholders.

We'd also point out that AUB Group issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. AUB Group's payout ratio is within normal bounds. Second, earnings growth has been mediocre, but at least the dividends have been relatively stable. In summary, we're unenthused by AUB Group as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Now, if you want to look closer, it would be worth checking out our free research on AUB Group management tenure, salary, and performance.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance