Costco (COST) to Report Q3 Earnings: What Awaits the Stock?

Costco Wholesale Corporation COST is likely to register an increase in the top line when it reports third-quarter fiscal 2020 numbers on May 28, after the closing bell. The Zacks Consensus Estimate for revenues is pegged at $37,516.9 million, indicating an improvement of 8% from the prior-year reported figure.

Again, we note that the Zacks Consensus Estimate for earnings for the quarter under review has decreased by 5.4% over the past 30 days to $1.91. Nonetheless, the figure suggests growth of roughly 1.1% from the year-ago period.

Notably, this Issaquah, WA-based company has a trailing four-quarter positive earnings surprise of 3.1%, on average. In the last reported quarter, the company delivered a positive earnings surprise of 1.5%.

Factors Influencing Costco’s Performance

Costco continues to be one of the dominant retail wholesalers based on the breadth and quality of merchandise offered. In fact, the company’s strategy to sell differentiated product range at discounted prices has been resulting in market share gains and higher sales per square foot. We believe that the company’s growth strategies, better price management and decent membership trends have been driving the top line.

Notably, as consumers stock up food and essentials items in the wake of coronavirus outbreak, Costco’s overall sales increased in the month of March. We note that comparable sales for the month rose 9.6%. However, the metric fell 4.7% in the month of April as stay-at-home orders, social distancing and some mandatory closures resulted in lower traffic and soft sales at warehouses.

Meanwhile, net sales declined 1.8% during the month of April, following a rise of 11.7% in March. Management pointed that sales for the month of April were adversely impacted by limited service in Travel and Food Courts; closures of most of Optical, Hearing Aid and Photo departments, and reduced volume and price deflation in Gasoline Business. Cumulatively, these hurt April sales by an estimated 12 percentage points, of which roughly 70% was due to gasoline business.

Nonetheless, the company’s e-commerce sales have been showcasing a sharp increase, courtesy of Costco’s loyal customer base who shopped for essentials from home amid the lockdown. E-commerce comparable sales soared 85.7% during the month of April. This follows an increase of 48.3% in the month of March.

The company is rapidly adopting the omni-channel mantra to provide a seamless shopping experience, whether online or in-stores. It has been steadily expanding e-commerce capabilities in the United States, Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

Certainly, the company’s growth efforts have been fueling traffic. However, analysts pointed that any deleverage in SG&A rate, higher labor and occupancy costs, and increased marketing and other store-related expenses might compress margins. Further, increasing competition on attributes such as price, products and speed to market cannot be ignored.

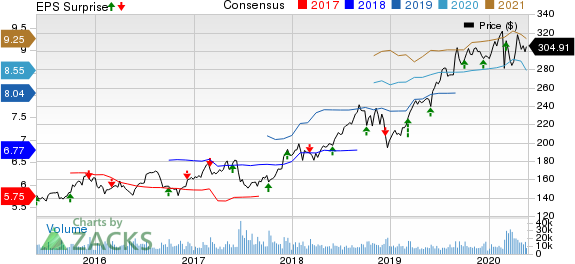

Costco Wholesale Corporation Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict a beat for Costco this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Costco has a Zacks Rank #3 but an Earnings ESP of -5.32%.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Big Lots BIG presently has an Earnings ESP of +19.01% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General DG has an Earnings ESP of +6.69% and a Zacks Rank #2, at present.

Guess' GES currently has an Earnings ESP of +12.75% and a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

Guess, Inc. (GES) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance