Coronavirus update: Business impact widens as China fights to get infections under control

China’s deadly coronavirus outbreak continues to threaten multi-national companies, as a range of businesses from leisure to retail suffer from the outbreak’s after-effects.

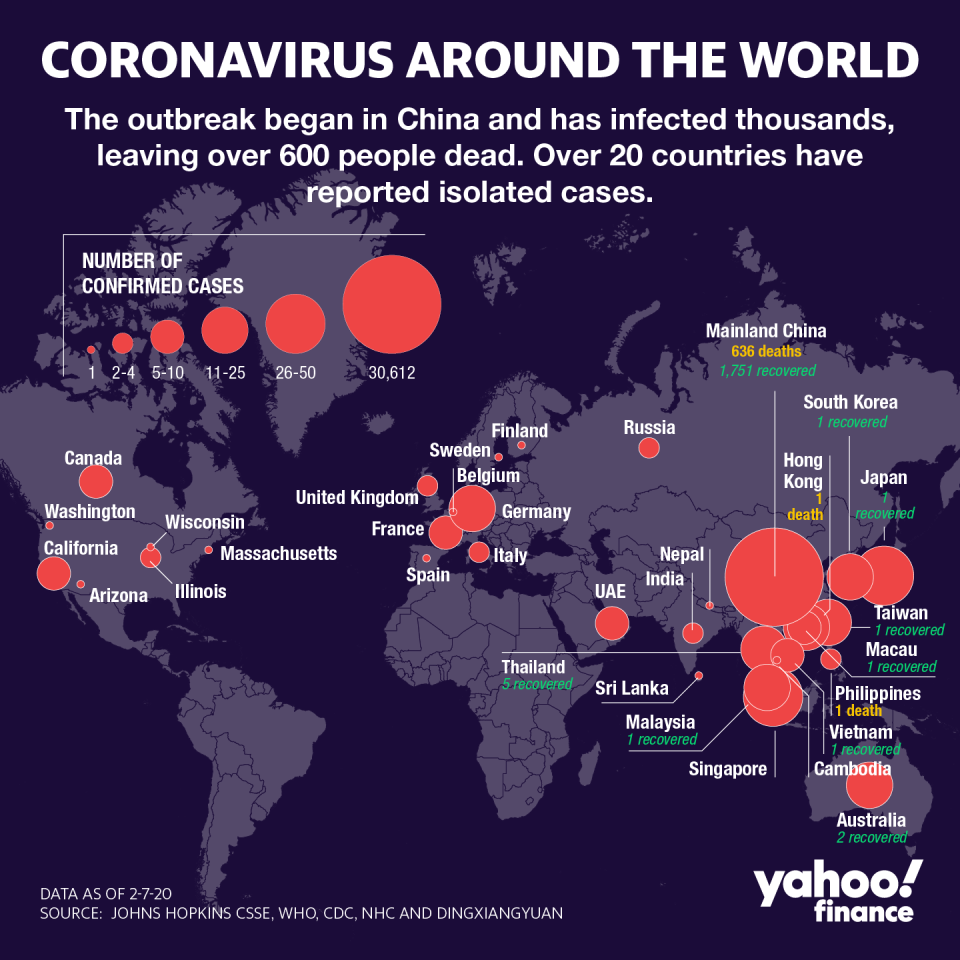

The number of confirmed cases in the country surged past 31,000 Friday, well beyond three times the number of cases last week. While the number of new cases daily have dipped slightly, World Health Organization officials said on Friday the organization’s not ready to declare the worst over.

As the death toll rises in the world’s second largest economy, a slew of major brands have pulled back — such as Starbucks, Apple and YUM. Burberry (BURBY) became the latest on Friday, by announcing it was shutting down several stores in the region.

Separately, Canada Goose (GOOS) warned the sickness was affecting its suppliers, and sliced its expected sales growth for the fiscal year.

It comes as the economic outlook becomes increasingly grim for China, which was already set to see growth slow down this year. JPMorgan Chase estimates that the coronavirus’ impact on the Chinese economy will be felt in the U.S. during the first quarter — shaving its growth estimates by a quarter percentage point, to 1.0%.

Meanwhile, the travel sector continues to suffer as an unprecedented number of cancellations for U.S. airlines, which are losing up to $1 million daily on the reduced or canceled routes to China and the region.

The virus continues to largely affect China, which reported its death tolls has surpassed 600 on Friday — including the whistleblower doctor who first flagged the growing contagion risk, who died from the virus.

What’s happening in markets

Growing fears about the Chinese economy are forcing economists to reevaluate global growth, and investors to reprice assets. Stocks on Friday suffered a relapse in coronavirus jitters, with major benchmarks closing sharply lower despite January employment data that beat expectations by a mile.

“China remains the largest supplier of imports to the US, even after the slowing caused by the trade war,” JPMorgan economists pointed out this week in a note to clients.

“While import growth should also soften, we think the topline effect of this will be mostly offset by inventory drawdowns, as thus far there appears to be no material impact of the coronavirus on U.S. domestic demand...As such, we are not penciling in significant effects on US growth from supply chain distortions. Nor do we see adverse confidence effects on economic activity.”

Still, the bank cut estimates for U.S. first quarter growth, saying that while “the domestic economic fallout of the coronavirus remains quite uncertain...today’s revision should be seen as an initial reaction.” This week, Goldman Sachs warned the impact on oil prices could drive them lower.

The impact on China’s economy, however, has been much clearer. Auto consultant LMC Automotive said on Friday that the virus’ spread could reduce the Chinese automotive sales and production by 3% to 5% this year.

The impact around the world

Cruises are taking more stringent precautionary measures, with Royal Caribbean (RCL) outright banning passengers who hold Chinese, Hong Kong or Macau passports until further notice. This after a ship which docked in Bayonne, N.J. Friday transported four passengers to a nearby hospital.

Meanwhile the Diamond Princess cruise docked in Japan, which is already quarantining its 3,700 passengers, reported an increase of confirmed cases. The ship now has more than 60 confirmed patients, a three-fold jump from a day earlier.

A market shortage in the supply of protective gear could hamper the global response to curbing the spread of the coronavirus.

While major biotech firms like Johnson & Johnson (JNJ) and Gilead (GILD) are racing to try and find a vaccine, experts say none of the interested companies are likely to find a vaccine in time for the outbreak.

There is one existing coronavirus vaccine approved in the U.S., which is produced by Merck (MRK). Yet it’s currently only available for dogs — and does not address the strain in China, which is known as 2019-nCoV.

Yet according to former FDA medical officer Henry Miller, it does give the company a leg up for manufacturing if a new vaccine is found.

Miller, currently a senior fellow at the Pacific Research Institute, told Yahoo Finance Friday that even if a vaccine is found, it isn’t going to be a profitable endeavor for the companies.

“In the last decade, companies have left vaccine production in droves,” he said. “It’s not very profitable in general, especially vaccines like this one that would be used once, if at all, and not on an ongoing basis.”

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance