Can I access the super $20k? And should I?

Australians will be able to access up to $20,000 from their superannuation over the coming two years as part of the government’s major second stimulus package.

‘House on fire’: More stimulus from government urgently needed

'Shaking with joy': Government doubles dole payment

Survival package: What the $66 billion means for you

But experts are calling on Australians to weigh up the positives and negatives of such a move before digging into their nest egg too early.

Who is eligible for $20,000 early superannuation access?

Generally, Australians can only access their superannuation once they reach the preservation age which is around 65, depending on what year they were born. However, as Covid-19 threatens millions of jobs, from April some Australians will be able to access up to $10,000 from their superannuation this financial year, and another $10,000 the next financial year, regardless of age.

To be eligible, they must have had their working hours reduced by 20 per cent or more, or be sole traders whose turnover has fallen by at least 20 per cent.

Australians who are unemployed, or eligible for a job seeker benefit, parenting payment, youth allowance or farm household allowance are also eligible.

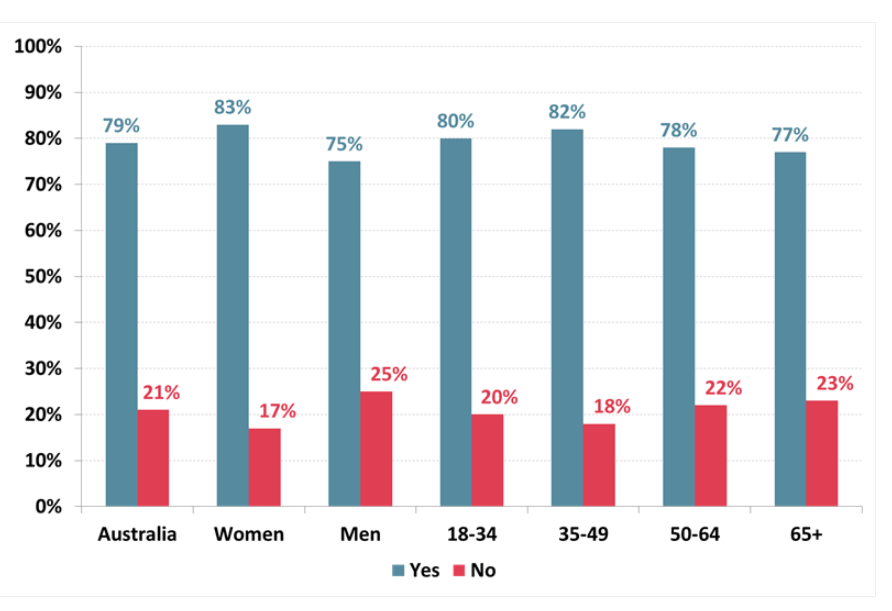

Most Australians (79 per cent) support the measure, a snap Roy Morgan poll released on Tuesday showed, with Australians across all age groups saying it made sense for people in financial strife to have access to their savings.

Should Australians be able to access up to $20,000 of their superannuation?

Treasurer Josh Frydenberg said the $3 trillion superannuation system will be able to weather the early withdrawals, but superannuation and insurance experts are calling on Australians to exercise caution before taking up the scheme.

The $120,000 retirement warning

The Australian Institute of Superannuation Trustees warned of potentially huge ramifications for Australians’ retirements.

It said Australians should consider “all other sources of income” before tapping into their superannuation.

A 20-year-old woman who took $20,000 from their super could lose as much as $120,000 from their balance by retirement due to foregone interest earnings, according to Industry Super Australia analysis.

And a 30-year-old who also took $20,000 from their super could lose around $100,000, while a 40-year-old could lose $63,000.

“Members should tread carefully and only think about cracking open their super after they’ve taken up the extra cash support on offer from the government- super should be the last resort given the impact it can have on your retirement nest egg,” Industry Super Australia chief executive Bernie Dean said.

“Members need to know that taking your super now is like selling a house at the bottom of the market- you’ll lose money you would probably claw back overtime.”

Opposition leader Anthony Albanese reiterated the point to Parliament on Monday, saying withdrawing superannuation while the market is tanking also means members are locking in those losses.

“Selling your super at the bottom of the market will risk squandering people’s hard-earned retirement savings,” he said..

“It is also the case if the superannuation industry is forced to sell assets at the bottom of the market. That also is not sensible economics.”

The insurance question

“While accessing $10,000 may seem like an easy way to keep afloat during tough economic times, you need to be aware of the downsides,” Slater and Gordon senior associate James Hunter said.

“Importantly, in relation to your insurance if you have either reduced or no contributions entering your fund, the ongoing administration fees, other fees, and insurance premiums together with the $10,000 lump sum could reduce your account balance to less than the $6,000 mandated limit.”

If your superannuation balance falls below this amount, your life insurance may be cancelled unless you speak to your super fund and choose to opt in to the cover, he said.

“If you do not contact them to continue receiving this insurance, you may find yourself uninsured should the worst happen, and you suffer a life changing injury or illness.”

Good to know. What are my other options?

As part of the major stimulus package announced on Sunday, the government is increasing welfare payments to unemployed Australians.

Many banks are also postponing mortgage repayments for six months to try to lessen the strain, while state and territory governments are currently considering ways to support tenants.

Slater and Gordon’s James Hunter said Australians in need should also contact the National Debt Helpline on 1800 007 007 before turning to superannuation.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance