Coronavirus will hit Aussie property markets: What that means for you

Is now a good time to buy property?

Should I hold off and wait for property values to fall further?

What’s ahead for our economy and the property markets as Australia falls into recession?

Our economy started the year with a little cold which progressed to the flu and now looks more like we’ll get a dose of economic pneumonia.

Just look where we are today…

Most of us are working from home, we’ve become good at social distancing, many businesses have closed (hopefully temporarily), the property market have been placed into hibernation with severe restrictions on inspections, the stock market has crashed, we are heading into recession and consumer and business confidence has tanked.

What’s next?

While I don’t want to make light of COVID-19, but based on my perspective having been involved in the property market for over 45 years, I believe the impact of this on our property market will ultimately be temporary.

I know this view is a little different to what others who are forecasting that property values will drop anywhere from 10 per cent to 30 per cent; but remember …this too shall pass.

What we are currently experiencing is like a terrorist attack which will deliver a short sharp blow to our economy rather than experiencing a long drawn out war.

What will happen to our property markets will depend upon how long we are in lockdown, how soon our economy picks up, the level of unemployment and importantly the level of consumer confidence coming out of our recession, which will be a good barometer of all the above factors.

Fortunately our federal government has learned a lot about handling monetary and fiscal policy during economic downturns resulting in the slashing of interest rates, the introduction of quantitative easing and spending $300 billion plus to build a bridge to get us through this and will now doubt spend a lot more to kickstart the economy.

At the same time the state governments have introduced their own support and stimulus packages.

Sure, unemployment will rise to double digits and unfortunately some businesses will not reopen, but the economy is likely to rebound in the 4th quarter of this year or early next year at which time we are likely to be experiencing a perfect storm for property.

The International Monetary Fund has forecast that the Australian economy will contract by 6.7 per cent in 2020, but expects the domestic economy to rebound by 6.1 per cent in 2021, assuming that measures to contain the virus are successful.

Of course if Australia experiences a much more prolonged downturn, caused by the world economy imploding, then of course property values would drop considerably.

I know some doomsayers are predicting this, but these are a not the type of forecasts made by the credible economists I have been following.

The short-term effects

Clearly our housing markets won’t be immune to the coronavirus economic fallout, but the impact on property values will depend on how long it will take to contain the virus.

Transaction levels will be significantly impacted over the next two to three months with discretionary sellers staying out of the market. It really makes no sense to put your property on the market for sale at this time unless you really need to.

However, there will always be non-discretionary buyers and sellers who do need to transact over the next little while.

It is likely that sellers will discount the price of their properties to conclude a sale, while buyers will take advantage of this to nab a bargain

But this doesn’t mean property values will plummet.

In fact, as an asset class, bricks and mortar has performed exceptionally well during previous economic shocks.

This time round, with the banks giving mortgage deferments or holidays, it is unlikely that we will have a large number of forced or mortgagee sales that could undermine market confidence.

I recognise that a logical argument, that is based on the laws of supply and demand, suggests that with unemployment rising and with fewer people able to purchase a property there will be less demand meaning property values will fall.

Sure, property values may fall a little in the next few months, but that won’t reflect their “intrinsic value” but will really be more of a reflection of the market lockdown.

And sooner rather than later we’ll come to a point where property transactions and prices will reflect the fundamentals of the Australian economy, as opposed to the current structural changes taking place.

On the flip side of the coin, suppressed transaction activity means we expect to see a build-up of latent demand and the markets will rebound in the latter part of this year.

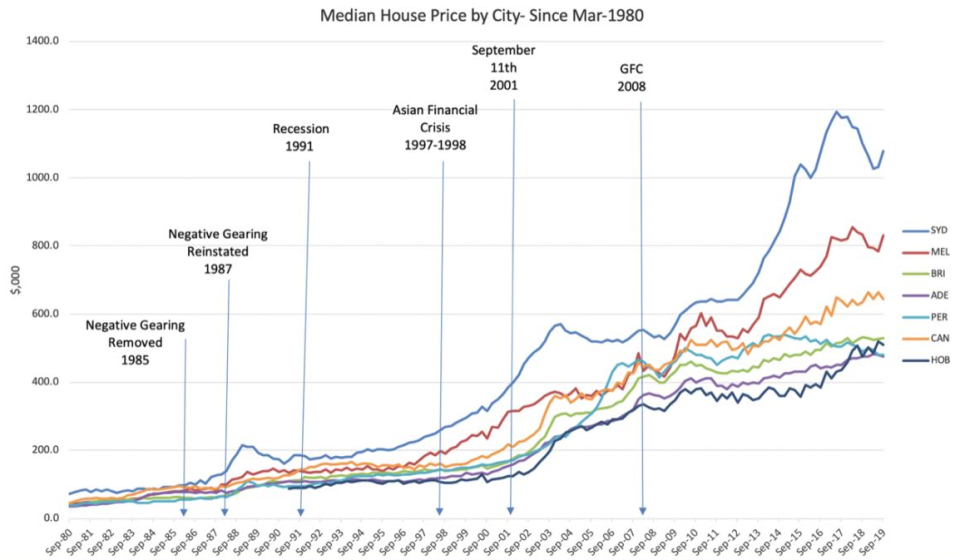

The chart below by Stuart Wemyss, of Prosolutions Private Clients supports my forecast.

The data suggests there’s a very weak relationship between average house price growth for subsequent 3-year period (green line) and unemployment (blue line.)

Many commentators are trying to compare the current markets predict how the current markets are going to perform based on how our property markets performed during previous economic downturns such as the Global Financial Crisis in 2008 or the recession of the early 1990’s.

However, unlike previous downturns that were essentially financially lead, this downturn is a medical problem that morphed in an economic issue because of a short-term shutdown of our economy which has led to a supply side downturn (even though we’d like to, we can’t go out and buy goods as their supply is limited because the shops are closed) rather than a lack of demand driven downturn.

This time round things are very different from a recession preceded by economic excess and speculation.

Because of this and based on the predicted pace of the post-recession recovery, I would expect the pandemic to have a more limited and shorter-lived impact on house prices than either the early-1990s recession or the Global Financial Crisis.

What does this mean for property prices?

In the short term:

“Investment grade” properties and A grade (above average) homes could fall in value by around -5 per cent

B grade (average) homes could fall in value by up -10 per cent,

C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and the pace of recovery from that point will depend on the state of the wider economy.

The worst affected residential markets will be:

Apartments in high-rise towers – in fact this is these properties are likely to be out of favour for quite some time.

Off the plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those close to universities.

Outer suburban new housing estates house and land packages, where young families are likely to have overextended themselves financially and with many people will be out of work for a while

Properties in the blue-collar areas.

On the positive side, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of price growth in the medium term.

However, I’m comfortable with the underlying long term fundamentals supporting our property markets int he medium to long term.

Sure our economy is taking a hit, but our property markets are underpinned by the fact that 70 per cent of property owners are home owners who are there for the long term.

They’re not going to sell up their homes – they’d rather eat dog food than give up their homes.

And the Australia’s banking system is strong, stable and sound.

Even though a few home buyers have overcommitted themselves financially, there should be no real concern about household debt because, in general, it is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

As the community starts to become more concerned about the economic impact of the coronavirus, it is likely that there will be a flight to quality assets, and bricks and mortar have always stood the test of time.

In other words, the share market volatility will make some investors look to real estate as an alternative secure investment vehicle underpinned by 7 million homeowners in Australia.

In fact, it the only investment market not dominated by investors.

So is now a good time to buy property?

One of the major lessons I have learned from previous downturns is the importance of taking a long-term perspective which always outsmarts short-term reactive thinking.

And for mine, it’s always property fundamentals that really matter and drive our markets in the long term.

Things like demographics, supply and demand, affordability, availability finance, and local economic trends.

Of course, we all know the old saying, being fearful when others are greedy and be greedy when others are fearful….

But it’s normal human nature to find it difficult to buy your new home or invest when everyone else is running around thinking the world is coming to an end.

However, now that I have invested through 8 property cycles, I have found that it is exactly these conditions the present the best opportunity.

That means now is the time to get prepared to take advantage of the opportunities that the market will offer.

After each global disruption, there has been an increase in property prices, and there is no reason to suggest this will be any different because, as I mentioned above, the fundamentals are still strong.

In my opinion for those who have a secure job and their finances organised, this is a great time to buy a home or investment property at a price that you were unlikely to be able to get a couple of weeks ago when the property markets in big capital cities were booming and there were more buyers around than sellers.

It is likely that human nature will cause many would-be buyers to sit on the sidelines for a little while until things become more clear, which means that sellers will be more amenable to accepting offers rather than holding out for a top price.

Remember don’t make long-term decisions like buying a home or an investment property based on the last 30 minutes of news.

There is no doubt there will be opportunities in the market for those who are willing to go against the crowd and when they look back in a year’s time and definitely in 5 or 10 years’ time, they will remember the unprecedented events of 2020 as a great buying opportunity for property.

Michael Yardney is a director of Metropole Property Strategists. He is a best-selling author, one of Australia's leading experts in wealth creation through property and writes the Property Update blog.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance