Corning (GLW) Beats Q2 Earnings Estimates, Misses on Revenues

Corning Incorporated GLW reported mixed second-quarter 2022 results, wherein the bottom line beat the Zacks Consensus Estimate but the top line missed the same. The company has updated its guidance based on the challenging macroeconomic environment. Shares mostly trended down in pre-market trading owing to the muted outlook as investors probably expected a healthy growth momentum.

Net Income

On a GAAP basis, net income in the quarter was $563 million or 66 cents per share compared with $449 million or a loss of 42 cents per share in the prior-year quarter. Core net income increased to $489 million or 57 cents per share from $459 million or 53 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by a penny.

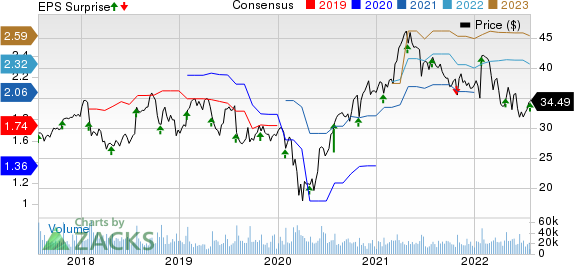

Corning Incorporated Price, Consensus and EPS Surprise

Corning Incorporated price-consensus-eps-surprise-chart | Corning Incorporated Quote

Revenues

Quarterly GAAP net sales increased 3.3% year over year to $3,615 million, driven by strong growth in Optical Communications and Hemlock’s solar materials. Core sales grew to $3,762 million from $3,504 million. The top line missed the consensus estimate of $3,779 million.

Segment Results

Net sales in Optical Communications increased 22.1% year over year to $1,313 million as network operators increased capital spending to address the demand for 5G, broadband and the cloud. The segment’s contribution to net income was $182 million compared with $148 million in the prior-year quarter led by strong volume and price increases.

Net sales in Display Technologies were $878 million compared with $939 million in the prior-year quarter, owing to lower volume and lower panel maker utilization. The segment’s net income was $228 million compared with $248 million in the year-ago quarter.

Specialty Materials' net sales were relatively flat year over year at $485 million. The company is witnessing significant demand for its premium cover materials and Advanced Optics products, backed by strength in the IT, mobile device and semiconductor markets. The segment’s net income was $91 million compared with $81 million a year ago.

Environmental Technologies’ net sales declined 12.5% year over year to $356 million as component shortages limited automotive production. Prolonged Russia-Ukraine war and fresh COVID-19 lockdown restrictions in China also affected segment sales. The segment’s net income was $62 million, down from $81 million in the year-earlier quarter.

Net sales in Life Sciences were flat year over year at $312 million as lower demand for COVID-related products was offset by growth in research and bioproduction. The segment’s net income declined to $37 million from $52 million a year ago. The decline was due to COVID-related lockdown restrictions in China, which adversely impacted output.

In Hemlock and Emerging Growth Businesses, net sales increased 45.1% year over year to $418 million. Demand for Hemlock’s solar materials grew while sales of semiconductor materials remained strong. Automotive Glass Solutions and Corning Pharmaceutical Technologies also contributed to growth. The segment’s net income was $25 million against a net loss of $15 million a year ago.

Other Details

Cost of sales increased 8.4% year over year to $2,369 million. Gross profit declined to $1,246 million from $1,315 million. Operating income was $490 million compared with $575 million a year ago.

Cash Flow & Liquidity

During second-quarter 2022, Corning generated $758 million of cash from operating activities compared with $771 million in the year-ago quarter, bringing the respective tallies for the first half of the year to $1,292 million and $1,494 million. Free cash flow decreased to $440 million in the quarter from $471 million in the prior year.

As of Jun 30, 2022, the company had $1,629 million in cash and cash equivalents with $6,677 million of long-term debt.

Outlook

Corning expects macroeconomic challenges to continue impact its third-quarter sales. For the third quarter, the company expects core sales in the range of $3.65 billion to $3.85 billion with core earnings per share of 51 cents to 55 cents. For the full year, management expects sales to slightly exceed $15 billion, with sales growing at 6-8% year over year and EPS growing in line with sales.

Zacks Rank & Stocks to Consider

Corning currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TESSCO Technologies Incorporated TESS, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 61.9%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 35.4% since July 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Ooma Inc. OOMA, carrying a Zacks Rank #2, delivered an earnings surprise of 34.7%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 11.4% since July 2021.

Ooma offers communications services and related technologies for businesses and consumers in the United States and Canada. It helps to create powerful connected experiences for businesses and consumers through its smart cloud-based SaaS platform.

Harmonic Inc. HLIT, carrying a Zacks Rank #2, delivered an earnings surprise of 79.8%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 35.4% since July 2021.

Harmonic provides video delivery software, products, system solutions, and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit internet service to consumers' homes and mobile devices.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

TESSCO Technologies Incorporated (TESS) : Free Stock Analysis Report

Ooma, Inc. (OOMA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance