Time running out to buy cheap property

Buyers hoping to enter the market are facing increasingly “competitive pressure” as prices rise and demand surges, new figures reveal.

Related story: ‘Ridiculous’ $100k stamp duty blasted by property exec

Related story: Where are Australia’s most expensive properties?

Related story: How your house price is affected by flight paths

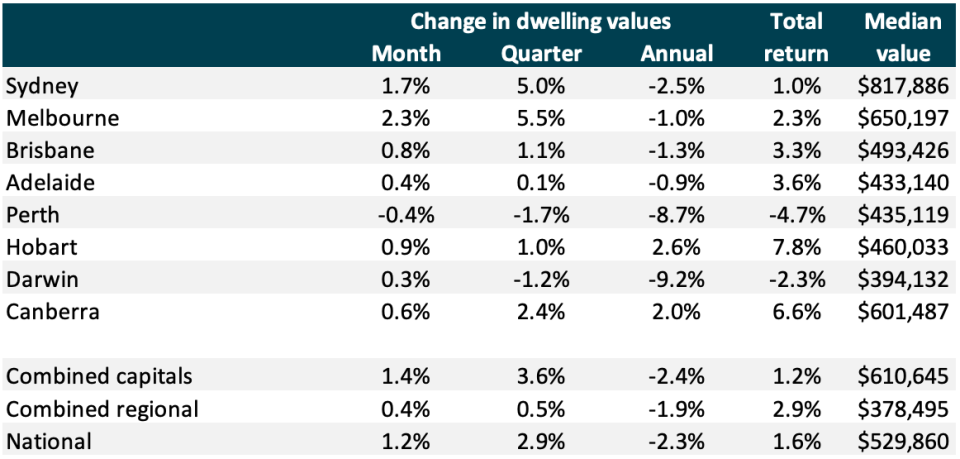

National house values rose 1.2 per cent in October, taking values 2.9 per cent higher since their lowest point in June, CoreLogic’s monthly house price index has revealed.

But while buyer numbers are increasing, the volume of homes on the market is still 11 per cent lower than this time last year.

“It’s becoming increasingly clear that the housing market rebound is gathering pace, both geographically and across the broad valuation cohorts, off the back of lower mortgage rates and improved access to credit, as well as an improvement in affordability relative to the market peak several years ago and consistently high demand via population growth,” CoreLogic research director Tim Lawless said on Friday.

“Demand for housing is responding to stimulus measures, including mortgage rates that are now lower than anything we have seen since the 1950’s and improved mortgage serviceability tests following APRA’s decision to adjust the minimum interest rate serviceability rules in July this year.”

The Reserve Bank of Australia has cut interest rates to record lows three times since June, offering buyers greater purchase power.

Related story: Here’s where Australian property prices are going in 2020

Related story: What if interest rate cuts fuel house prices but nothing else?

Related story: Property expert’s top 20 suburbs

But there has been a shortage of fresh listings for the last few years, Lawless said, noting that this has caused some “pent up demand”

“Despite the improved selling environment, new stock additions remain low for this time of the year, which is likely a reflection of ongoing uncertainty and low confidence.”

He said total advertised stock levels are down 11 per cent on last year, and close to their lowest levels since 2010.

“Such a small pool of available stock against rising buyer demand is creating some competitive pressure amongst buyers which is adding to urgency in the market and supporting upwards pressure on values.”

Melbourne’s blockbuster month

While Sydney saw dwelling values jump 1.7 per cent, bringing quarterly growth to 5.0 per cent, dwelling values in Melbourne soared 2.3 per cent in October alone.

In fact, Perth was the only capital city to record a fall in values, down 0.4 per cent.

Lawless said Sydney and Melbourne’s strong performance was down to tighter labour market conditions and strong population growth, in addition to low interest rates.

And while Perth did dip, Lawless said it is starting to improve, with Perth reporting its smallest quarterly dip in 14 months.

Hobart saw valued increase 0.9 per cent, while Brisbane saw values jump 0.8 per cent.

In Canberra, values were up 0.6 per cent and in Darwin prices were up 0.3 per cent. And in Adelaide, prices were up 0.4 per cent.

“Focusing on housing market conditions across the broad value-based cohorts highlights that the market recovery is being led by the most expensive quarter of the market, although values are also rising across the more affordable strata as well, just not as rapidly.”

Across the capital city sub-regions, like inner-east Melbourne and north Adelaide, only seven of the 46 regions have seen growth in the last 12 months, but in the last three months, a massive 38 of the 46 sub-regions have seen positive growth.

“Such a broad-based lift in values across the capital city sub-regions over the most recent three month period demonstrates the depth of the current housing market recovery.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance