Core Molding Technologies Inc (CMT) Q1 2024 Earnings: A Mixed Financial Performance Amid Market ...

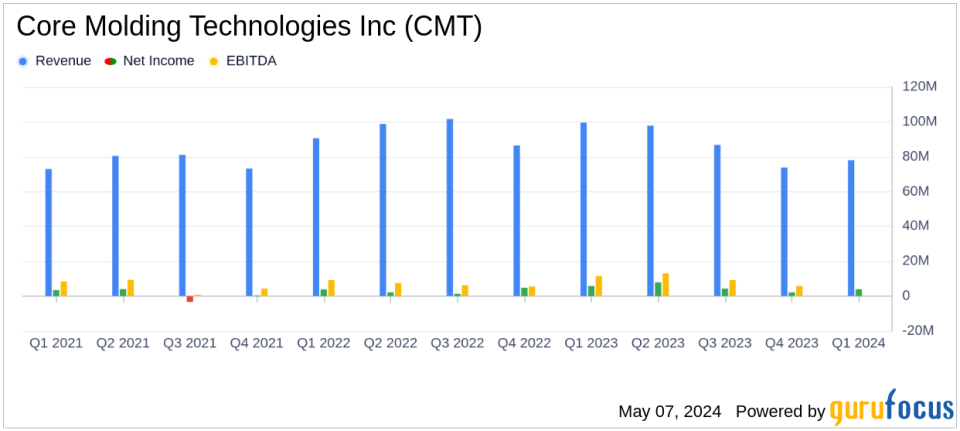

Revenue: Reported $78.1 million, a decrease of 21.5% year-over-year, but exceeded estimates of $77.70 million.

Net Income: Achieved $3.8 million, down 35.8% from the previous year, surpassing the estimated $2.33 million.

Earnings Per Share (EPS): Recorded at $0.43 per diluted share, exceeding the estimated $0.26.

Gross Margin: Totaled $13.3 million or 17.0% of net sales, showing a decrease from 17.8% year-over-year, and declined sequentially from 17.5%.

Operating Income: Posted $4.7 million or 6.1% of net sales, a decline from 8.1% in the same period last year.

Adjusted EBITDA: Reported at $8.7 million or 11.2% of net sales, indicating a decrease from 12.3% year-over-year but an improvement from 8.9% in the previous quarter.

Free Cash Flow: Generated over $3 million this quarter, showing an increase compared to the same period last year.

On May 7, 2024, Core Molding Technologies Inc (CMT) disclosed its financial results for the first quarter of fiscal year 2024 through its 8-K filing. The company, a key player in the engineered materials sector, reported a notable decline in sales but demonstrated operational resilience with improved gross margins and a robust strategic outlook.

Financial Highlights and Analyst Expectations

Core Molding Technologies reported total net sales of $78.1 million for Q1 2024, a decrease of 21.5% compared to the same period last year but a sequential improvement of 5.9% from Q4 2023. This performance slightly surpassed analyst expectations of $77.70 million. However, net income for the quarter was $3.8 million or $0.43 per diluted share, significantly higher than the estimated $0.26 per share, showcasing a strong earnings management despite revenue pressures.

Operational and Market Challenges

The company faced several challenges during the quarter, including market demand fluctuations and operational de-leveraging. Despite these hurdles, Core Molding Technologies managed to maintain a gross margin of 17.0%, reflecting a 220 basis point improvement from the previous quarter. This resilience is attributed to the company's aggressive cost reduction strategies and market-based pricing implementations.

Strategic Initiatives and Future Outlook

David Duvall, CEO of Core Molding Technologies, emphasized the company's improved position compared to two years prior, citing significant strides in operational efficiency and market diversification. The company's focus remains on continuous improvement and growth investments, particularly in sales development and technical capabilities. These efforts are aligned with the growing demand for environmentally friendly and sustainable products, potentially benefiting from infrastructure projects under the Buy America, Build America (BABA) Act.

Financial Position and Capital Allocation

As of March 31, 2024, Core Molding Technologies reported a strong liquidity position with $76.6 million available, including cash and undrawn credit facilities. The company's prudent management is evident in its strategic capital expenditures, totaling $1.9 million for the quarter, aimed at enhancing operational capacities.

Investor and Analyst Perspectives

John Zimmer, EVP and CFO, provided insights into the company's financial strategy, noting alignment with projected sales declines and a focus on maintaining profitability through operational efficiencies. The company anticipates a 10% to 15% full-year sales decrease but remains committed to navigating these challenges effectively.

Conclusion

While Core Molding Technologies faces a challenging market environment, its strategic initiatives and strong financial management position it well for future stability and growth. Investors and stakeholders may find reassurance in the company's ability to exceed earnings expectations and maintain robust gross margins amidst industry volatility.

For a more detailed analysis and future updates, investors are encouraged to follow the developments of Core Molding Technologies Inc (CMT) closely.

Explore the complete 8-K earnings release (here) from Core Molding Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance