Corcept Therapeutics Inc (CORT) Outperforms Analyst Estimates in Q1 2024

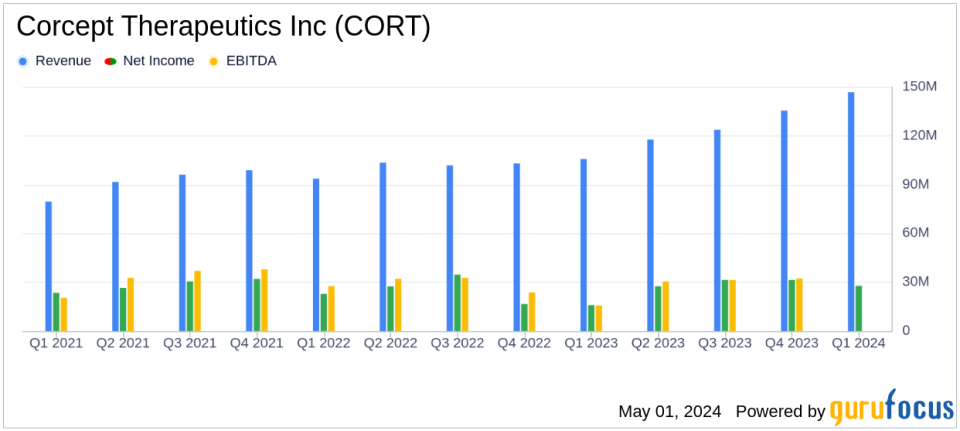

Revenue: Reported at $146.8 million, a 39% increase year-over-year, surpassing estimates of $141.20 million.

Net Income: Reached $27.8 million, significantly exceeding the estimated $25.27 million.

Earnings Per Share (EPS): Diluted EPS stood at $0.25, above the estimated $0.22.

2024 Revenue Guidance: Increased to $620 - $650 million from previous projections of $600 - $630 million.

Cash and Investments: Grew to $451.0 million as of March 31, 2024, up from $425.4 million at the end of the previous quarter.

Operating Expenses: Increased to $117.3 million, up from $90.8 million in the same quarter last year, reflecting higher clinical trial activity and commercial team expansion.

On May 1, 2024, Corcept Therapeutics Inc (NASDAQ:CORT) released its 8-K filing, announcing a robust financial performance for the first quarter ended March 31, 2024. The company reported a significant revenue increase to $146.8 million, up 39% from $105.7 million in the same quarter the previous year, surpassing the estimated revenue of $141.20 million. Net income also exceeded expectations, reaching $27.8 million compared to the estimated $25.27 million, with earnings per share (EPS) at $0.25, outperforming the analyst estimate of $0.22.

Corcept Therapeutics Inc, a pioneering firm in the pharmaceutical industry, focuses on the discovery and development of treatments for severe metabolic, oncologic, and neuropsychiatric disorders by modulating the effects of cortisol. The company's flagship product, Korlym, continues to gain traction, with a record number of new prescribers and patients in the first quarter, highlighting the growing recognition of hypercortisolism's prevalence.

Financial and Operational Highlights

The company's financial strength is evident in its increased 2024 revenue guidance, now ranging from $620 million to $650 million, up from the previous forecast of $600 million to $630 million. This adjustment reflects Corcept's confidence in its ongoing and future market performance. Additionally, Corcept reported a healthy cash and investment balance of $451.0 million as of March 31, 2024, an increase from $425.4 million at the end of 2023, providing a solid foundation for sustained growth and development activities.

Strategic Clinical Advancements

Corcept's clinical development pipeline remains robust, with significant progress reported across multiple trials. The GRACE trial for relacorilant in Cushings syndrome showed promising open-label phase results, with the randomized withdrawal phase results eagerly anticipated within the quarter. The company also completed enrollment for several other critical trials, including GRADIENT, CATALYST, ROSELLA, and DAZALS, with results expected by the year's end.

"Relacorilant has demonstrated tremendous promise as a treatment for patients with Cushings syndrome. Patients in GRACEs open-label phase exhibited significant improvements across a broad range of clinically meaningful endpoints, without significant safety burden," said Bill Guyer, PharmD, Corcepts Chief Development Officer.

Enhanced Market Position and Future Outlook

Corcept's strategic initiatives and expanding market presence have positioned it well for continued growth. The company's focus on addressing unmet medical needs through innovative cortisol modulation therapies is proving effective, as evidenced by the strong quarterly results and optimistic revenue projections. With several pivotal clinical trial results expected in the coming months, Corcept is poised to maintain its momentum and strengthen its market position.

Overall, Corcept Therapeutics Inc's first-quarter performance not only underscores its financial robustness but also highlights its potential to lead in the biotechnology field with groundbreaking therapies. As the company continues to advance its clinical programs and expand its commercial footprint, it remains a notable entity in the biotech sector, offering promising prospects for value investors.

For detailed financial figures and further information, please refer to the full earnings report on Corcept's website or access the direct filing here.

Explore the complete 8-K earnings release (here) from Corcept Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance