Copart (CPRT) to Report Q1 Earnings: What's in the Offing?

Copart, Inc. CPRT is scheduled to release first-quarter fiscal 2020 results after the closing bell on Nov 20. The Zacks Consensus Estimate for the quarter to be reported is earnings per share of 58 cents on revenues of 531 million.

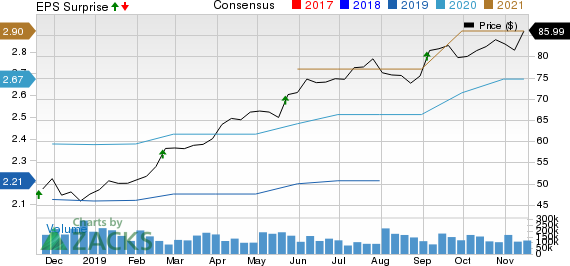

In the last reported quarter, the Texas-based company beat the consensus mark by 5.26%, primarily on the back of higher service revenues. As far as earnings surprises are concerned, the online vehicle auctioning company has an excellent record, having outpaced the Zacks Consensus Estimate in each of the last four quarters. This is depicted in the graph below:

Copart, Inc. Price, Consensus and EPS Surprise

Copart, Inc. price-consensus-eps-surprise-chart | Copart, Inc. Quote

While investors are anticipating that Copart — whose peers include Ritchie Bros. Auctioneers Incorporated RBA, Byd Co., Ltd. BYDDY and Liquidity Services Inc. LQDT — will surpass earnings estimates this time around, our model does not predict the same.

Trend in Estimate Revision

The Zacks Consensus Estimate for revenues is pegged at $531 million, indicating an improvement from $461 million recorded in the prior-year quarter. The Zacks Consensus Estimate for fiscal first-quarter earnings has remained stable over the past two months at 58 cents per share, which suggests growth from 47 cents recorded in the corresponding quarter of the prior year.

Let's delve deeper into factors that are likely to have influenced Copart’s fiscal first-quarter earnings.

Factors Setting the Tone

Copart’s active presence across U.S. and international markets is likely to have aided worldwide sales volumes. High activity levels in the United States and expansion efforts in Canadian and European markets are expected to have boosted the firm’s revenues for the to-be-reported quarter. During fiscal first-quarter 2020, the company made an expansion of 40 acres in its Atlanta East location. It also announced an expansion of location in Calgary and Montreal by 20 acres and 24 acres, respectively.

Evidently, the Zacks Consensus Estimate for service revenues and vehicle sales is pegged at $462 million and $75 million, indicating year-over-year growth of 16.9% and 11.9%, respectively.

In addition to opening hubs and expanding its network of facilities, the company’s strategic acquisitions are also likely to have driven revenues. Copart’s buyout of Kentucky-based online auctioning platform, Vincent Auto Solutions, has strengthened its footprint in western Kentucky and is likely to have contributed to sales in the quarter to be reported.

However, increased investments to support growth initiatives — including domestic and international expansion of business — may have dented the firm’s margins. As it is, the company has been bearing the brunt of high operating expenses over the last several quarters. The trend is likely to have lowered its profit levels to some extent.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Copart this time around. This is because it doesn't have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Zacks Consensus Estimate and the Most Accurate Estimate are pegged at 56 cents a share.

Zacks Rank: Copart currently has a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copart, Inc. (CPRT) : Free Stock Analysis Report

Ritchie Bros. Auctioneers Incorporated (RBA) : Free Stock Analysis Report

Liquidity Services, Inc. (LQDT) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance