Cooper Companies (COO) Q4 Earnings Lag Estimates, Margins Up

The Cooper Companies, Inc. COO reported fourth-quarter fiscal 2021 adjusted earnings per share (EPS) of $3.28, up 3.8% year over year. The bottom line, however, lagged the Zacks Consensus Estimate by 2.7%.

The company’s GAAP EPS was $2.21 in the quarter, up 34.8% year over year.

Full-year adjusted EPS was $13.24, reflecting a 37.3% increase from the year-ago period. Again, the metric lagged the Zacks Consensus Estimate by 0.7%.

Revenue Details

Revenues grossed $759.1 million in the reported quarter, up 11.4% year over year (up 11% at constant exchange rate or CER). The metric surpassed the Zacks Consensus Estimate by 1.5%.

Full-year revenues were $2.92 billion, up 20.2% year over year (up 18% at CER). The metric surpassed the Zacks Consensus Estimate by 0.3%.

Segmental Details

Cooper Companies operates through two business units — CooperVision ("CVI") and CooperSurgical ("CSI").

CVI segment’s revenues totaled $564.8 million, up 12% on a reported basis and 11% at CER. The segment’s revenues were primarily driven by Cooper Companies’ daily silicone hydrogel portfolio.

CVI segment’s Toric contact lens (32% of CVI) revenues amounted to $181.3 million, up 12% both on a reported basis and at CER.

Multifocal contact lens (11% of CVI) generated revenues of $61.3 million, up 15% both on a reported basis and at CER.

Single-use sphere lenses (29% of CVI), reflect an improvement of 12% both on a reported basis and at CER. Single-use sphere lenses revenues totaled $166.5 million.

Non-single-use sphere (28% of CVI) revenues were $155.7 million, up 9% on a reported basis and 8% at CER.

Geographically, the segment witnessed an improvement in revenues in the Americas (39% of CVI), up 6% both on a reported basis and at CER to $217.9 million.

EMEA revenues (38% of CVI) totaled $213.9 million, up 17% year over year on a reported basis and 15% at CER.

Asia Pacific revenues (23% of CVI) totaled $133 million, up 13% year over year on a reported basis and 14% at CER.

The CSI segment reported revenues of $194.3 million, up 11% year over year both on a reported basis and at CER.

CSI’s sub-segment Office and Surgical products (58% of CSI) accounted for $112.7 million in revenues, up 3% year over year both on a reported basis and at CER.

Fertility (42% of CSI) revenues were $81.6 million, up 23% year over year on a reported basis and 24% at CER.

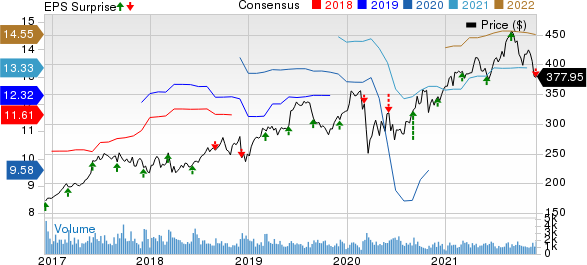

The Cooper Companies, Inc. Price, Consensus and EPS Surprise

The Cooper Companies, Inc. price-consensus-eps-surprise-chart | The Cooper Companies, Inc. Quote

Margin Analysis

In the quarter under review, Cooper Companies’ gross profit rose 18.4% to $501.9 million. Gross margin expanded 391 basis points (bps) to 66.1%.

Selling, general and administrative expenses rose 17.9% to $311.6 million. Research and development expenses went up 0.4% year over year to $25.6 million. Adjusted operating expenses of $337.2 million increased 16.4% year over year.

Adjusted operating profit totaled $164.7 million, which surged 22.6% from the prior-year quarter. Adjusted operating margin in the fiscal fourth quarter expanded 199 bps to 21.7%.

Financial Position

Cooper Companies ended fiscal 2021 with cash and cash equivalents of $95.9 million compared with $115.9 million at the end of fiscal 2020. Total debt at the end of fiscal 2021 was $1.48 billion compared with $1.79 billion at the end of fiscal 2020.

Cumulative net cash provided by operating activities at the end of fiscal 2021 was $738.6 million compared with $486.6 million a year ago.

Guidance

Cooper Companies has initiated its financial guidance for fiscal year 2022 after taking into account the significant risk stemming from the resurgence in COVID-19 cases.

For fiscal 2022, the company projects total revenues between $3,032 million-$3,090 million (up 6-8% at CER). The Zacks Consensus Estimate for the same is currently pegged at $3.09 billion, which matches the upper end of the company-provided outlook.

CVI revenues are estimated to be in the range of $2,225 million-$2,267 million (up 6-8% at CER) whereas CSI revenues are expected to lie within $807 million-$823 million (up 6-8% at CER).

Adjusted EPS is anticipated to be $13.60-$14.00 (up 9.5-12.5% at CER). The Zacks Consensus Estimate for the same currently stands at $14.55.

Our Take

Cooper Companies exited the fiscal 2021 fourth quarter with better-than-expected revenues. The company witnessed solid performances across its core CVI and CSI units during the quarter under review, along with robust geographical performances. Strength in the company’s daily silicone hydrogel and myopia management portfolios is impressive. Cooper Companies’ announcement to acquire Generate Life Sciences to boost its fertility, and labor and delivery offerings raise our optimism. The launch of MyDay multifocal in the United States and various major European markets, and positive feedback and results regarding the same, also look encouraging. Expansion of both margins is another positive.

However, lower-than-expected earnings in the reported quarter are concerning.

Zacks Rank and Stocks to Consider

Cooper Companies currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space that have announced quarterly results are Laboratory Corporation of America Holdings LH or LabCorp, Thermo Fisher Scientific Inc. TMO and AMN Healthcare Services AMN.

LabCorp, carrying a Zacks Rank #2 (Buy), reported third-quarter 2021 adjusted EPS of $6.82, which beat the Zacks Consensus Estimate by 42.9%. Revenues of $4.06 billion outpaced the consensus mark by 13.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LabCorp has an estimated long-term growth rate of 10.6%. The company surpassed estimates in the trailing four quarters, the average surprise being 25.73%.

Thermo Fisher reported third-quarter 2021 adjusted EPS of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Third-quarter revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%. It currently carries a Zacks Rank #2.

Thermo Fisher has an estimated long-term growth rate of 14%. The company surpassed estimates in the trailing four quarters, the average surprise being 9.02%.

AMN Healthcare reported third-quarter 2021 adjusted EPS of $1.73, which surpassed the Zacks Consensus Estimate by 29.1%. Third-quarter revenues of $877.8 million outpaced the Zacks Consensus Estimate by 12.3%. It currently sports a Zacks Rank #1.

AMN Healthcare has an estimated long-term growth rate of 16.2%. The company surpassed estimates in the trailing four quarters, the average surprise being 19.51%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance