Contagion from Turkey's lira crash could reach the US

The crash of Turkey’s lira currency has been generating the lion’s share of headlines recently, but it’s not the only emerging country dealing with a crisis, and some experts are beginning to see the makings of a much broader market crash.

In addition to the lira, the Iranian rial, the Russian ruble, the Indian rupee, the Argentine peso, the Chilean peso, the Chinese yuan and the South African rand have all sunk against the U.S. dollar this year and seen significant and accelerated selling in the past few days.

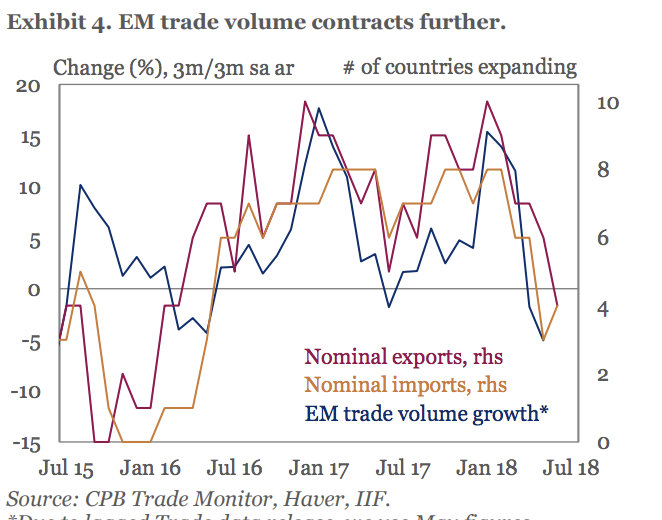

Robin Brooks, chief economist at the Institute of International Finance (IIF), an organization that polls and lobbies on behalf of banks around the world, says that he’s seeing the beginnings of a cycle of contagion in global capital flows that signals a looming downturn that could wreak havoc on risk assets, including U.S. stocks.

Brooks points to the collusion of multiple shocks to the global financial system, including global central banks tightening monetary policy, the yuan’s rapid loss of value as a result of trade tensions with the United States and other geopolitical tensions.

“There are lots of shocks going on at the same time,” Brooks told Yahoo Finance in an email. “Turkey is just a small piece of that, but the potential for the entire EM complex to suffer is elevated at this time, because – although each shock by itself doesn’t look so material – taken together they are. And that also means that risk assets more broadly, including [U.S. stocks], are vulnerable.”

As an example, he says, consider the August 2015 U.S. stock market selloff in response to worries about China.

‘The contagion story is very live’

In addition to major drawdowns in the value of currencies in major economies like Russia, China and India, the IIF also has seen significant selling in Indonesian, Lebanese and Egyptian currencies.

“The contagion story is very live,” Brooks said in a call with reporters early Tuesday. “Capital flows are quite indicative of contagion potential.”

The Bank of International Settlements warned in 2016 that American monetary policy and a strong U.S. dollar were straining the global financial system.

“The key takeaway is that a stronger dollar is associated with more severe market anomalies,” BIS economic adviser Hyun Song Shin said in a speech at the World Bank in Washington that year.

‘A bubble waiting to pop’

BIS data shows debt issued in U.S. dollars to non-bank borrowers rose to $11.5 trillion in March – the highest total in the 55-year history of the bank’s records. Turkey is an especially profligate actor, analysts point out, but as more of the currencies of emerging countries weaken against the dollar, it will become increasingly difficult for Turkey and others to pay their debts.

“This could be a bubble waiting to pop,” Jacob L. Shapiro, director of analysis at Geopolitical Futures, a global think tank, said in a note to clients. “Especially if vulnerable countries don’t have the monetary policy options to protect themselves.”

IIF reported in July the amount of debt held in the world rose by $8 trillion during the first quarter of 2018, the largest margin in two years, hitting more than $247 trillion. That is 318% of the world’s gross domestic product, a level the organization’s managing director called “cause for concern.”

Exposed and vulnerable

Jurgen Odenius, an economic counselor at PGIM Fixed Income, Prudential’s asset management arm, argues that Turkey’s problems have been brought about by a worrisome backdrop of declining global liquidity, meaning higher interest rates and tighter central bank policy, which restricts growth. However, he doesn’t see it as a symptom of or a catalyst for a larger financial meltdown.

“There’s a reason that Turkey is the canary in the coal mine – it’s the most exposed and most vulnerable,” Odenius told Yahoo Finance via phone.

Odenius said Turkey’s especially large deficit, which has been heavily financed in now much more expensive dollars, is at the heart of its problems. He sees Turkey and the other countries that have seen their currencies “fall out of bed” as outliers who are now paying for their free-spending ways.

Similarly, Dec Mullarkey, managing director, investment strategies at Sun Life Investment Management, doesn’t believe Turkey is a large or important enough player in the system to usher in a global financial crisis.

“A lot of times crisis comes through just sentiment,” he said during a phone conversation. “But you’d need a bigger fish to go down.”

Some investors are worried that could be what’s next, as the dominoes in emerging markets stack and begin to fall. The most worrisome is China, where the stock market has tumbled and economic indicators are slowing in addition to the major fall in its currency’s value. That’s been due in no small part to the ongoing trade war with the U.S. and tariffs imposed by President Donald Trump, a story for which analysts see no end in sight.

“If you’re talking full-on trade war and other scenarios,” Odenius said, “that’s a different game.”

—

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

A Trump trade war victory over China could be disastrous for the US

What the collapse of Turkey’s currency means for the US and the rest of the world

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

Yahoo Finance

Yahoo Finance