Constellation Brands' (STZ) Strong Brands Help Retain Momentum

Constellation Brands Inc. STZ has stayed ahead of the curve, thanks to its solid brand portfolio and continued efforts to lift the brands through its premiumization efforts. The company’s beer business has particularly been gaining from robust performances of Modelo Especial and Corona Extra, and newer brands, Pacifico and the Modelo Chelada. Additionally, its high-end Power Brands, including The Prisoner Brand Family, Kim Crawford and Meiomi, within the Wine & Spirits segment, have been the key growth drivers.

These factors, coupled with the company’s premiumization strategy and expansion endeavors, have been aiding its quarterly performance. In fourth-quarter fiscal 2024, the company’s sales advanced 11% year over year in the beer business. The upside was driven by a 10.5% increase in shipment volumes and 8.9% depletion growth. Depletion volume benefited from the solid demand for its high-end brand portfolio.

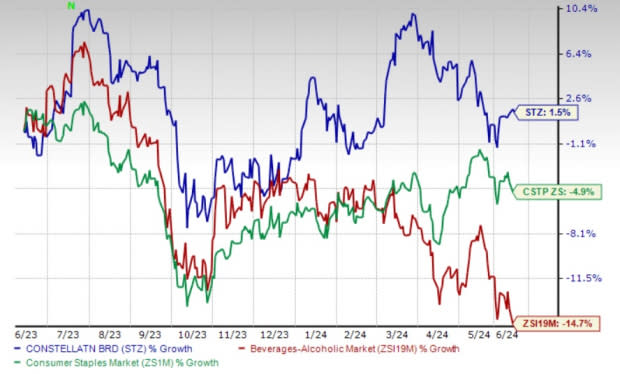

Shares of this Zacks Rank #3 (Hold) company have gained 1.5% in the past year against the industry’s 14.7% decline. The alcohol beverage company also compared favorably with the sector’s decline of 4.9%.

The Zacks Consensus Estimate for STZ’s current financial-year sales and earnings indicates growth of 6.5% and 12.3%, respectively, from the year-ago reported numbers.

Image Source: Zacks Investment Research

What Places STZ Well?

Backed by the strength in the beer business, the company remains on track with its plans to invest in the next phase of capacity expansion in Mexico. This will help meet the potential demand for the high-end Mexican beer portfolio, including the emerging Alternative Beverage Alcohol sub-space, which includes hard seltzers.

The company has invested in its Beer Business throughout fiscal 2024, deploying nearly $950 million in capital expenditure. The expansion will support an addition of up to 30 million hectoliters of modular capacity and includes the construction of a brewery in Southeast Mexico’s Veracruz. It also targets continued expansion, and the optimization of the existing Nava and Obregon breweries.

Additionally, Constellation Brands' premiumization strategy is playing out well, as evidenced by the accelerated growth of the Power Brands in fourth-quarter fiscal 2024. Its Wine and Spirits Business has been shifting its portfolio to higher-end brands that are better aligned with consumer-led premiumization trends. The company is making investments to fuel growth of its power brands through innovation, capitalizing on priority and consumer trends, with successful product introductions.

The beer segment also witnessed gains from premiumization, driven by growth in traditional beer and the flavors category, including seltzers, flavored beer, RTD spirits and flavored malt beverages.

Hiccups

Constellation Brands has been witnessing elevated raw material, packaging and logistic costs for a while now. Increased depreciation and operating costs from brewery capacity expansions have been acting as deterrents. Inflationary pressures are concerning as well.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely The Vita Coco Company Inc. COCO, Vital Farms VITL and PepsiCo Inc. PEP.

Vita Coco, a producer and marketer of coconut water products under the Vita Coco brand name, currently flaunts a Zacks Rank of 1 (Strong Buy). COCO has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COCO’s current financial-year sales and earnings suggests growth of 3.5% and 40.5%, respectively, from the year-ago reported figures.

Vital Farms offers a range of produced pasture-raised foods. VITL presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 102.1%, on average.

The consensus estimate for Vital Farms’ current financial year’s sales and earnings per share indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported figures.

PepsiCo, a leading global food and beverage company, currently carries a Zacks Rank #2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PEP’s current financial-year sales and earnings indicates growth of 3.4% and 7.1%, respectively, from the year-earlier actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance