ConocoPhillips (COP) Q4 Earnings Lag Estimates, Revenues Beat

ConocoPhillips COP has reported fourth-quarter 2022 adjusted earnings per share of $2.71, missing the Zacks Consensus Estimate by a penny. The bottom line improved from the prior-year quarter’s $2.27 per share.

One of the world’s largest independent oil and gas producers based in Houston, TX, ConocoPhillips’ quarterly revenues of $19,262 million increased from fourth-quarter 2021 sales of $15,963 million. Also, the top line beat the Zacks Consensus Estimate of $17,518 million.

Weaker-than-expected quarterly earnings resulted from lower natural gas liquid price and increased expenses. The negatives were partially offset by higher oil-equivalent production volumes.

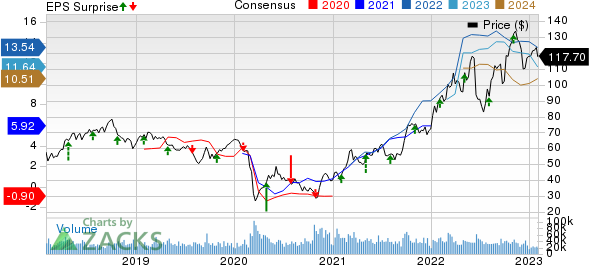

ConocoPhillips Price, Consensus and EPS Surprise

ConocoPhillips price-consensus-eps-surprise-chart | ConocoPhillips Quote

Dividend

ConocoPhillips has announced a quarterly ordinary dividend of 51 cents per share, unchanged from the last paid dividend. The dividend is payable on Mar 1, 2023, to stockholders of record at the close of business on Feb 1, 2023. Additionally, COP announced a variable return of cash payment of 60 cents per share.

ConocoPhillips announced its 2023 planned return of capital to shareholders of $11 billion.

Production

Total production averaged 1,758 thousand barrels of oil equivalent per day (MBoe/d), up from the year-ago quarter’s 1,608 MBoe/d. Of the total output, 52% was crude oil. Overall production was higher than the year-ago period primarily due to the increased production in the Lower 48.

ConocoPhillips’ crude oil production was 912 thousand barrels per day (MBbls/d), higher than the year-ago quarter’s 836 MBbls/d. Production of natural gas liquids totaled 269 MBbls/d, higher than the year-ago period’s 194 MBbls/d. Bitumen production for the quarter was 69 MBbls/d, up from the year-ago quarter’s 68 MBbls/d. However, the company’s natural gas production was 3,046 million cubic feet per day (MMcf/d), lower than the year-ago level of 3,058 MMcf/d.

Realized Prices

Average realized oil equivalent prices rose to $71.05 per barrel from the year-ago level of $65.56.

The average realized crude oil price for the fourth quarter was $85.58 per barrel, reflecting an increase from the year-ago figure of $76.76. The average realized natural gas price for fourth-quarter 2022 was $10.44 per thousand cubic feet, up from the year-ago period’s $8.66. However, realized natural gas liquids price was $27.21 per barrel, lower than the year-ago quarter’s $37.72. The average realized bitumen price was $34.47 per barrel, reflecting a decline from the year-ago level of $40.74.

Total Expenses

ConocoPhillips’ fourth-quarter total expenses rose to $14,027 million from $11,627 million in the corresponding period of 2021.

Production and operating expenses rose to $1,885 million for the reported quarter from $1,543 million a year ago. Similarly, the cost of purchased commodities rose to $8,735 million for the quarter from $6,498 million a year ago. Exploration costs increased to $263 million for the December-end quarter of 2022 from $138 million in the comparable period of 2021.

Balance Sheet & Capital Spending

As of Dec 31, 2022, ConocoPhillips had $6,458 million in cash and cash equivalents. The company had a total long-term debt of $16,226 million. It had a debt-to-capitalization ratio of 0.257. At the fourth-quarter end, the company had short-term debt of $417 million.

Capital expenditure and investments totaled $2,533 million, and dividend payments grossed $2,390 million. Net cash provided by operating activities was $6,592 million.

Reserves

The company ended 2022 with proved reserves of 6.6 billion barrels of oil equivalent (Boe) and a reserve replacement ratio of 176%. Through 2022, the upstream energy player produced 1,738 thousand Boe per day, comprising more than 51.7% oil.

Guidance

For 2023, ConocoPhillips expects total production of 1.76-1.8 million barrels of oil equivalent per day (MMBoe/d). For the first quarter, COP expects production between 1.72 MMBoe/d and 1.76 MMBoe/d.

For 2023, the company stated its total capital budget of $10.7-$11.3 billion, which includes $9.1-$9.3 billion for base capital and $1.6-$2 billion for major projects.

Zacks Rank & Stocks to Consider

ConocoPhillips currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Liberty Energy Inc. LBRT announced fourth-quarter 2022 earnings per share of 82 cents, which handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impact of strong execution and increased service pricing.

LBRT is expected to see an earnings surge of 61.1% in 2023. As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents in the fourth quarter.

Halliburton Company HAL reported a fourth-quarter 2022 adjusted net income per share of 72 cents, surpassing the Zacks Consensus Estimate of 67 cents. The outperformance reflects stronger-than-expected profit from both its divisions.

HAL is expected to see earnings growth of 43.7% in 2023. In more good news for investors, Halliburton raised its quarterly dividend by 33.3% to 16 cents per share (or 64 cents per share annualized).

Valero Energy Corporation VLO reported fourth-quarter 2022 adjusted earnings of $8.45 per share, beating the Zacks Consensus Estimate of $7.45 per share. The strong quarterly results were driven by increased refinery throughput volumes and a higher refining margin.

Valero can benefit from the Gulf Coast export volumes as fuel demand recovery gets support from Asia economies. The Gulf Coast contributed 59.4% to the total throughput volume in the fourth quarter of 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance