Conn's (CONN) Looks Well-Placed, Highlights Growth Targets

Conn's, Inc. CONN unveiled that management will offer details related to the company’s improved strategic growth plan as well as its operating and financial targets on its Investor Day. The specialty retailer of consumer electronics, furniture and mattresses, home office products and home appliances and the provider of consumer credit appears to be in great shape.

Conn’s is well-placed for delivering growth and creating value for stockholders by solidifying its core business, improving the credit business and speeding up e-commerce growth. The company’s exclusive business model is targeted at enhancing customers’ experiences. On that note, let’s take a closer look at the three-year financial and operating goals, which the company will highlight on its Investor Day.

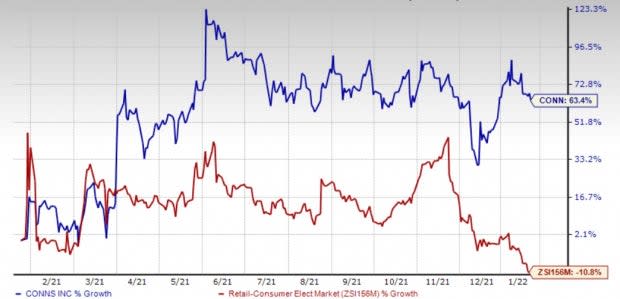

Image Source: Zacks Investment Research

Conn’s’ 3-Year Targets

The company aims at increasing total revenues to nearly $2-$2.2 billion, reflecting an estimated CAGR of 9-12%. Further, CONN intends to boost its e-commerce revenues and take it from nearly 6% of the total retail revenues (in the third quarter of fiscal 2022) to about 20%. Conn’s plans to generate high single-digit EBIT margin. Moving on, it aims to continue with geographic expansion. Finally, it intends to maintain a stable credit business and produce a credit spread of at least 1,000 basis points.

The company is positioned well for growth, returning value to shareholders. Conn’s commitment to shareholders can be underscored by its recently unveiled share buyback authorization. In December 2021, management approved share buybacks worth $150 million, which will expire on Dec 14, 2022. This reflects the company’s healthy balance sheet as well as confidence in its growth prospects.

Talking of the balance sheet, the company ended the third quarter of fiscal 2022 with cash and cash equivalents of $10.6 million. As of Oct 31, 2021, Conn’s had $320.5 million worth of immediate borrowing capacity under its revolving credit facility of $650 million. In the third quarter, net earnings per share (EPS) more than doubled to 60 cents. During the quarter, total revenues surged 21.3% to $405.5 million. E-commerce sales soared a whopping 294.8% to $19.2 million.

The abovementioned targets highlight Conn’s solid future potential. Shares of this Zacks Rank #3 (Hold) company have rallied 63.4% in the past year against the industry’s decline of 10.8%.

3 Retail Stocks to Bet on

Here are three better-ranked stocks – Albertsons Companies ACI, Dollar Tree DLTR and Costco COST.

Albertsons Companies, a leading food and drug retailer in the United States, sports a Zacks Rank #1 (Strong Buy). The company has an expected EPS growth rate of 8% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Albertsons Companies’ current financial-year sales suggests growth of 1.5% from the year-ago period. ACI has a trailing four-quarter earnings surprise of 31.8%, on average.

Dollar Tree, the operator of discount variety retail stores, holds a Zacks Rank #2 (Buy). Dollar Tree has a trailing four-quarter earnings surprise of 8.8%, on average. The company has an expected EPS growth rate of 12.2% for three to five years.

The Zacks Consensus Estimate for DLTR’s current financial-year sales suggests growth of 3.4% from the year-ago period.

Costco, which operates membership warehouses, carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 8.3%, on average.

The Zacks Consensus Estimate for Costco’s current financial-year sales and EPS suggests growth of 10.9% and 14%, respectively, from the year-ago period. COST has an expected EPS growth rate of 8.8% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Conn's, Inc. (CONN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance