CONMED (CNMD) Earnings and Revenues Beat Estimates in Q4

CONMED Corporation CNMD reported fourth-quarter 2019 adjusted earnings per share of 90 cents, which beat the Zacks Consensus Estimate of 89 cents by 1.1%. Further, the figure improved 23.3% from the year-ago quarter.

The New York-based medical products manufacturer reported revenues of $264.9 million, up 9.2% on a year-over-year basis and 9.3% at constant currency (cc). Notably, the figure surpassed the Zacks Consensus Estimate by 0.01%.

2019 at a Glance

In 2019, the company reported revenues worth $955.1 million, which improved 11.1% from the previous year.

Adjusted EPS for the year was $2.64, which improved 21.1% from 2018.

Segment Details

Orthopedic Surgery

Revenues in the segment totaled $123.8 million, down 0.8% from the year-ago quarter.

Both domestically and on international basis Orthopedics revenue fell 0.8% from their respective prior-year quarter's levels.

General Surgery

Revenues in the segment totaled $141.1 million, up 19.9% year over year.

Domestically, General Surgery sales improved 23.1% year over year and international sales advanced 14%.

Sales by Geography

In the reported quarter, sales in the United States amounted to $142.5 million, up 13.8% year over year. International sales improved 4.4% to $122.4 million.

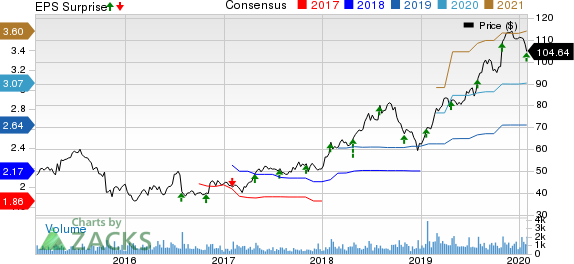

CONMED Corporation Price, Consensus and EPS Surprise

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Margins

Gross profit in the quarter totaled $141.9 million, up 7% year over year. Per management, adjusted gross margin was 54.1%, contracting 60 bps.

Operating income came in at $27.9 million, up 7.9% year over year. Operating margin was 10.5%, down 20 bps year over year.

Financial Condition

Cash flow from operations for the year was $95.1 million compared with $74.7 million in 2018. Long-term debt at the end of the year was $753.6 million, down 3.5% sequentially.

2020 Guidance

CONMED expects 2020 organic constant currency sales growth between 7% and 7.5%. On the basis of current exchange rates, the negative impact to 2020 sales from forex is now anticipated between 120 bps and 150 bps.

CONMED projects adjusted diluted net earnings per share in the range of $3.08 to $3.13, indicating growth of about 17-19% over 2019. Notably, the Zacks Consensus Estimate is pegged at $3.04, lower than the guided range.

Wrapping Up

CONMED exited the fourth quarter on a solid note, wherein earnings and revenues beat the respective estimates. The company’s core unit — General Surgery — continues to aid the top line. Solid international sales growth remains a positive. Strong 2020 guidance instills optimism in the stock. The company continues to expect investments in R&D to be between 4.5% and 5% of sales in 2020.

Apart from this, the company completed the successful integration of the Buffalo Filter buyout and launched a wide array of innovative new products. Notably, CONMED exited the year by raising investment in its sales organization during the fourth quarter as planned, further strengthening its foundation for sustainable near- and long-term revenue and profitability growth.

Meanwhile, the company’s high long-term debt remains a concern. Further, the company’s Orthopedic Surgery unit displayed weak performance in the quarter under review. Additionally, CONMED operates in a highly competitive environment, especially with respect to the General Surgery business.

Zacks Rank

CONMED currently carries a Zacks Rank #2 (Buy).

Other Key Picks

Some other top-ranked stocks in the broader medical space are SeaSpine Holdings Corporation SPNE, STERIS plc STE and DexCom, Inc. DXCM, all three carrying a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for SeaSpine’s fourth-quarter 2019 revenues is pegged at $43.6 million, suggesting growth of 14.7% from the prior-year reported figure. The same for loss per share is anticipated at 44 cents, indicating an improvement of 16.9% from the year-ago reported figure.

The Zacks Consensus Estimate for STERIS’s fourth-quarter fiscal 2020 revenues is pegged at $749.7 million, indicating an improvement of 7.7% from the year-earlier reported figure. The same for adjusted earnings per share stands at $1.43, indicating growth of 13.5% from the year-ago reported figure.

The Zacks Consensus Estimate for DexCom’s fourth-quarter 2019 revenues is pegged at $457 million, suggesting growth of 35.2% from the prior-year reported figure. The same for adjusted earnings per share stands at 72 cents, indicating an improvement 33.3% from the prior-year reported figure.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

SeaSpine Holdings Corporation (SPNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance