CONMED (CNMD) Down on Q4 Earnings Miss, New System Hurts Sales

CONMED Corporation CNMD delivered adjusted earnings per share (EPS) of 42 cents for fourth-quarter 2022, significantly missing the Zacks Consensus Estimate of 93 cents by 54.8%. The bottom line declined 60.7% from the year-ago quarter’s levels.

GAAP EPS for the quarter was 86 cents, compared with 75 cents in the year-ago quarter.

Revenues in Detail

CONMED’s fourth-quarter revenues were $250.9 million, down 8.4% year over year. The top line missed the Zacks Consensus Estimate by 18.1%. At the constant exchange rate (“CER”), revenues decreased 7%. Additional sales from newly-acquired businesses contributed approximately 240 basis points of growth.

The quarterly sales were significantly impacted due to the implementation of a new warehouse management system. The company had previously withdrawn its guidance for full-year 2022 in November last year, citing temporary disruption due to implementation of this new warehouse management software. It is intended to increase the efficiency and performance of its primary distribution facility. However, the new software created shipping disruptions that lasted longer than originally projected.

CONMED Corporation Price, Consensus and EPS Surprise

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Full Year Results

CONMED reported full-year revenues of $1.01 billion, up 3.4% year over year. Sales were up 4.6%, at CER. Adjusted EPS for 2022 was $2.65, down 17.4% from the previous year.

Segment Details

Revenues in the Orthopedic Surgery segment totaled $115.2 million, down 2% from the year-ago quarter on a reported basis. At CER, revenues decreased 0.3%.

Orthopedics revenues improved 15% on a reported basis on the domestic front, while declining 11.7% (down 9% at CER) from the prior-year quarter’s levels on the international front.

Revenues in the General Surgery segment amounted to $135.7 million, down 13.2% year over year on a reported basis and 12% at CER.

Domestically, General Surgery sales decreased 11.5% year over year, whereas international sales declined 16.9% on a reported basis (down 13.1% at CER).

Sales by Geography

In the reported quarter, sales in the United States amounted to $142.8 million, down 3.9% year over year. International sales were $108.1 million, down 13.8% year over year on a reported basis and 10.6% at CER.

Margins

In the quarter under review, CONMED’s gross profit declined 15.4% to $131.9 million. The gross margin declined 430 basis points (bps) to 52.6%.

Selling & administrative expenses increased 12.5% to $120.7 million. Research and development expenses rose 7.6% year over year to $12.2 million.

The company recorded an operating loss of $1.1 million against operating profit of $37.2 million in the prior-year quarter.

2023 Guidance Maintained

CONMED announced updated guidance for revenues and EPS in 2023. The company now expects reported revenues to be between $1.170 billion and $1.220 billion for full-year 2023, implying growth of 14.3% over 2022. Previously, it expected revenues to be between $1.170 billion and $1.230 billion. The Zacks Consensus Estimate currently stands at $1.21 billion.

Adjusted EPS for the full year is now expected in the range of $3.20-$3.45 compared with the previous expectation of $3.20-$3.50. Current EPS guidance indicates an anticipated improvement of 20.8-30.2% year-over-year. The Zacks Consensus Estimate currently stands at $3.37.

It expects foreign exchange to have unfavorable impact on the top line growth by 150 and 200 basis points in 2023. EPS is likely to be impacted negatively by 20-25 cents due to currency rates.

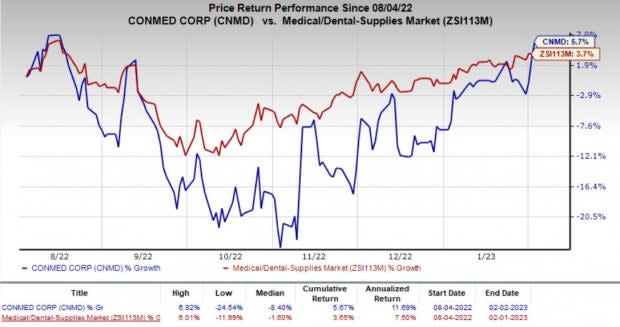

Shares of CONMED were down 4.1% during after-hours trading on Feb 2, following the significantly lower-than-expected earnings, and lower revenues and EPS outlook for 2023. However, the company’s shares have gained 5.7% in the past six months against the industry’s decline of 3.7%.

Image Source: Zacks Investment Research

Our Take

CONMED exited the fourth quarter on a weaker note, wherein earnings and revenues missed their respective consensus mark significantly. The current decline in revenues and EPS is most likely due to the implementation of the new system, which hampered the company’s ability to ship customer orders. Although the disruption during the implementation phase will gradually improve, duration of the system’s successful integration is yet to be seen. The company is steadily resolving the issues and clearing its backlog of orders created due to the software-related disruption. Management, on the fourth-quarter earning,s call stated that the company’s global shipping volumes are at or above normal daily volumes. We expect sales and EPS to improve significantly as the system-related disruption wanes.

Meanwhile, the acquisition of In2Bones and Biorez last year is likely to bring additional sales for CONMED in 2023. Revenues from these two companies’ businesses exceeded management’s expectation so far.

Zacks Rank and Stocks to Consider

Currently, CONMED carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Neogen Corporation NEOG, McKesson Corporation MCK and Hologic, Inc. HOLX.

Neogen, carrying a Zacks Rank #2 (Buy), reported second-quarter fiscal 2023 adjusted EPS of 15 cents, beating the Zacks Consensus Estimate of a loss of 8 cents per share. Revenues of $230 million outpaced the consensus mark by 0.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Neogen has a return on equity of 5.6% against the industry’s negative return. NEOG’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average being 70.1%.

McKesson, having a Zacks Rank #2, reported third-quarter fiscal 2023 adjusted EPS of $6.90, which beat the Zacks Consensus Estimate by 8.8%. Revenues of $70.49 billion outpaced the consensus mark by 0.02%.

McKesson has a long-term estimated growth rate of 10.1%. MCK’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average being 3.4%.

Hologic reported first-quarter fiscal 2023 adjusted earnings of $1.07 per share, beating the Zacks Consensus Estimate by 18.9%. Revenues of $1.07 billion surpassed the Zacks Consensus Estimate by 9.5%. It currently sports a Zacks Rank #1.

Hologic has a long-term estimated growth rate of 15.2%. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance