Confluent Inc (CFLT) Q1 2024 Earnings: Surpasses Revenue Estimates with Strong Subscription Growth

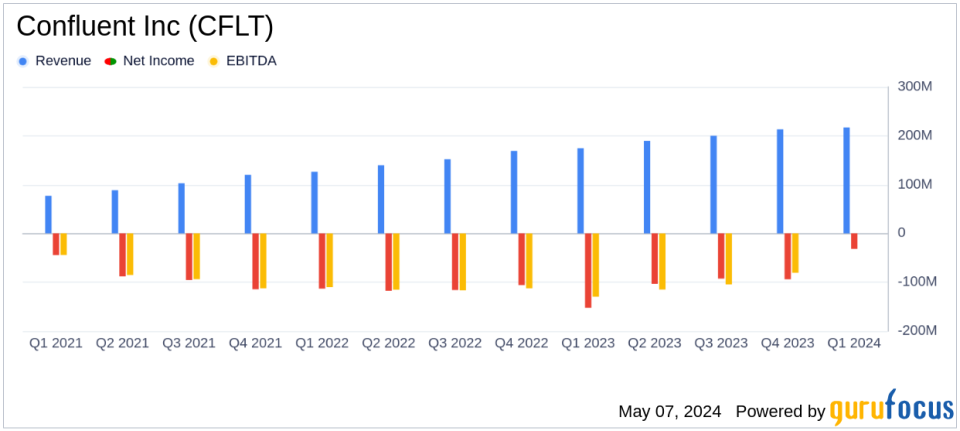

Total Revenue: Reported at $217.2 million, marking a 25% increase year-over-year, surpassing the estimated $212.14 million.

Achieved $206.9 million, a 29% rise from the previous year, indicating strong growth in core services.

GAAP Net Loss Per Share: Recorded at $(0.30), an improvement from $(0.52) year-over-year, but fell below the estimated earnings per share of $0.02.

Non-GAAP Net Income Per Diluted Share: Reported at $0.05, significantly exceeding the estimated earnings per share of $0.02.

Free Cash Flow: Improved by $51.2 million year-over-year to $(31.7) million, reflecting better operational efficiency.

GAAP and Non-GAAP Operating Margins: Showed substantial improvements; GAAP operating margin improved by 44.0 percentage points, and Non-GAAP operating margin improved by 21.6 percentage points.

Customer Growth: Number of customers with $100,000 or greater in ARR increased by 17% year-over-year to 1,260, demonstrating strong market adoption.

On May 7, 2024, Confluent Inc (NASDAQ:CFLT), a leader in data streaming technology, released its 8-K filing showcasing its financial results for the first quarter of 2024. The company reported a significant 25% year-over-year increase in total revenue, reaching $217 million, and a 29% increase in subscription revenue at $207 million. Confluent's cloud services, a major component of its subscription model, saw an impressive 45% growth, underscoring its increasing market penetration and the growing demand for real-time data solutions.

Confluent Inc is at the forefront of a new category of data infrastructure aimed at connecting applications, systems, and data layers around a real-time central nervous system. With a majority of its revenue derived from the United States, Confluent's products, including the Confluent Platform and various connectors, cater to a wide range of sectors such as financial services, retail, and government.

Financial Performance and Market Impact

The first quarter results not only demonstrate Confluent's ability to increase revenue but also reflect a significant reduction in losses. The GAAP operating loss was reduced by $54.7 million year-over-year, and the non-GAAP operating loss decreased by $37 million. This improvement is a testament to Confluent's enhanced operational efficiency and scaling capabilities. Notably, the company's shift towards a subscription-based model is yielding positive results, with subscription revenue now forming the core of its earnings.

Confluent's CEO, Jay Kreps, highlighted the strategic importance of Confluent Cloud, which has become the fastest-growing segment of the company's offerings. CFO Rohan Sivaram also noted the early signs of success in the company's consumption transformation, which is pivotal for sustainable growth.

Challenges and Forward-Looking Statements

Despite the positive trends, Confluent faces challenges, including a GAAP net loss of $0.30 per share. However, the non-GAAP figures were more favorable, with a net income of $0.05 per diluted share, a significant improvement from a loss of $0.09 per share in the same quarter last year. The company's future outlook remains optimistic with an expected total revenue of approximately $957 million for the fiscal year 2024 and a subscription revenue forecast of around $910 million.

The company's ongoing transition from total revenue to a focus on subscription revenue starting from Q3 2024 indicates a strategic pivot towards more predictable and stable revenue streams. This move is likely to appeal to investors looking for long-term value in the rapidly evolving tech landscape.

Operational and Strategic Developments

Operationally, Confluent has managed to reduce its cash used in operating activities significantly, from $77.8 million in Q1 2023 to $26 million in Q1 2024. This improvement in cash flow management is crucial as the company continues to invest in innovation and market expansion.

Strategically, the emphasis on enhancing the Confluent Platform and expanding its suite of data streaming products is set to solidify the company's market position. The focus on developing DSP (data stream processing) products that connect, process, and govern data reflects Confluent's commitment to addressing the comprehensive needs of modern enterprises.

In conclusion, Confluent Inc's first quarter of 2024 illustrates a company that is not only growing its top line but also improving its operational efficiencies and strategically positioning itself for future growth. With its strong performance in subscription and cloud revenues, Confluent is well-positioned to leverage the expanding role of data streaming in digital transformation.

For detailed financial figures and future projections, interested parties can access the full earnings report and supplementary materials on Confluents investor relations website.

Explore the complete 8-K earnings release (here) from Confluent Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance