Comtech (CMTL) Growth Strategy Gets a Boost With $100M Investment

Comtech Telecommunications Corp. CMTL recently announced that private equity firms, White Hat Capital Partners LP and Magnetar Capital, have invested $100 million to revamp and boost its growth strategy and leadership transition plan.

Per the deal, the investment entities will initially purchase $100 million of convertible preferred stock. This will then be converted into shares of Comtech valued at $24.50 per share. This is subject to an adjustment of $26.00 per share based on Comtech's FY22 financial performance.

The preferred stock includes a 6.5% dividend, which will be payable in either cash or kind at Comtech's election. With nearly $13.8 billion of assets under management, the agreement will accelerate growth in Comtech’s 911 business and satellite technology while capturing lucrative M&A opportunities.

The strategic investment, which is subject to customary closing conditions, is expected to close this month. Comtech stated that the proceeds from this transaction will be utilized to complete the set-up of its technology centers and advanced manufacturing capabilities located in Basingstoke, the U.K., and Chandler, AZ.

White Hat and Magnetar’s investment supports Comtech’s vision and continued transformation efforts and aims to enhance its financial flexibility. With more than two decades of industry experience, Comtech has been making necessary efforts to provide critical location and messaging solutions for enterprises, governments, and mobile network operators for public safety.

This much-awaited investment will propel Comtech’s strategic initiatives in next-gen public safety solutions and capture value from the increasing demand for satellite ground station infrastructure. With the continuation of its annual dividend program, the investment will also optimize capital allocation and maximize shareholder value.

Thanks to this sustainable long-term bullish growth outlook, Comtech can seamlessly leverage opportunities in the satellite earth station and public safety markets, driven by higher customer demand. The investment firms can capitalize on their in-depth technology expertise to drive incremental growth and generate recurring revenue streams for Comtech.

Zacks Rank & Stocks to Consider

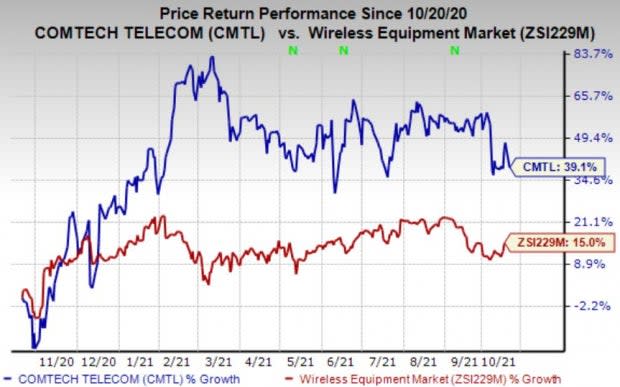

Comtech currently has a Zacks Rank #4 (Sell). Its shares have gained 39.1% compared with the industry’s growth of 15% in the past year.

Image Source: Zacks Investment Research

Some better-ranked stocks in the industry are Clearfield, Inc. CLFD, Motorola Solutions, Inc. MSI, and Ubiquiti Inc. UI. While Clearfield currently sports a Zacks Rank #1 (Strong Buy), Motorola and Ubiquiti carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered a trailing four-quarter earnings surprise of 49%, on average.

Motorola delivered a trailing four-quarter earnings surprise of 9.6%, on average.

Ubiquiti delivered a trailing four-quarter earnings surprise of 20.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance