Compelling Reasons to Hold on to HCA Healthcare (HCA) Stock

HCA Healthcare, Inc. HCA continues to benefit from growing patient admissions, acquisitions and a solid financial position.

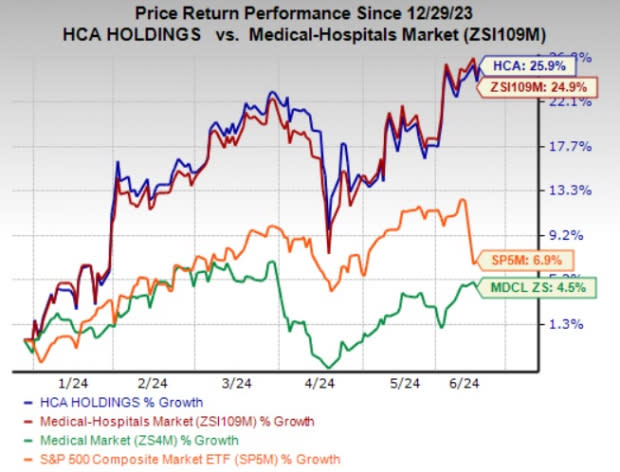

Zacks Rank & Price Performance

HCA Healthcare carries a Zacks Rank #3 (Hold) at present.

The stock has gained 25.9% year to date compared with the industry’s 24.9% growth. The Medical sector and the S&P 500 composite index have increased 4.5% and 6.9%, respectively, in the same time frame.

Image Source: Zacks Investment Research

Favorable Style Score

HCA is well-poised for progress, as evidenced by its impressive VGM Score of A. Here V stands for Value, G for Growth and M for Momentum, and the score is a weighted combination of all three factors.

Robust Growth Prospects

The Zacks Consensus Estimate for HCA Healthcare’s 2024 earnings is pegged at $20.92 per share, indicating an improvement of 10.1% from the year-earlier reading, while the same for revenues is $69.6 billion, implying a 7.2% increase from the prior-year actual.

The consensus mark for 2025 earnings is pegged at $23.19 per share, indicating 10.9% growth from the 2024 estimate. The same for revenues is $73.2 billion, implying 5.1% growth from the 2024 estimate

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 earnings has been revised 0.4% upward in the past 30 days.

Decent Surprise History

HCA’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 5.64%.

Solid Return on Equity

HCA Healthcare’s return on equity in the trailing 12 months is significantly higher than the industry’s average, which substantiates its efficiency in utilizing shareholders’ funds.

Business Tailwinds

HCA Healthcare's revenue growth has been driven by improved patient volumes, which remain the primary contributor to any healthcare facility operator's top line. In the first quarter, same facility admissions rose 6.2% year over year. Management estimates 2024 revenues within the range of $67.8-$70.3 billion, the midpoint of which indicates 6.2% growth from the 2023 reported figure.

The resumption of deferred elective procedures is anticipated to attract more patients to HCA's surgery centers in the coming days. An increase in elective surgeries translates to higher inpatient occupancy levels, thereby boosting HCA Healthcare's revenues. The company operated 121 freestanding surgery centers as of Mar 31, 2024.

The rise in outpatient surgeries and emergency room visits is expected to continue driving the company's revenue growth. HCA Healthcare also extends telehealth services that can be availed within the comfort of one’s home. It has behavioral hospitals in place to address the growing incidence of mental health issues among Americans.

Over the years, HCA's acquisitions have broadened its healthcare portfolio, diversified its income streams and expanded its nationwide presence. In the first quarter, the company spent $96 million on acquiring hospitals and healthcare entities.

The healthcare provider boasts sufficient cash reserves and adequate cash-generation abilities that are immensely required to pursue growth initiatives and return capital to shareholders through share repurchases and dividend payments. Cash and cash equivalents were $1.3 billion as of Mar 31, 2024, which improved 37.3% from the 2023-end level. Net cash provided by operating activities advanced nearly 37% year over year in the first quarter.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

The company's debt-laden balance sheet creates financial risk. As of Mar 31, it held a total debt of $40.2 billion. Elevated debt levels induce an increase in interest expenses, which rose 6.9% year over year in the first quarter and are projected to be between $1.985-$2.040 billion in 2024.

Despite cost-reduction efforts, expenses continue to be on the rise with a 10.4% increase in the first quarter. Investments in clinical systems, digital capabilities, care models, workforce programs and network capital are expected to keep costs on an uptick in the days ahead.

Stocks to Consider

Some better-ranked stocks in the Medical space are Organon & Co. OGN, Enovis Corporation ENOV and Ligand Pharmaceuticals Incorporated LGND. While Organon sports a Zacks Rank #1 (Strong Buy), Enovis and Ligand Pharmaceuticals carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Organon’s earnings surpassed estimates in three of the last four quarters and missed the mark once, the average surprise being 13.62%. The Zacks Consensus Estimate for OGN’s 2024 earnings indicates a 6.8% rise while the same for revenues implies an improvement of 1.7% from the respective prior-year tallies. The consensus mark for OGN’s earnings has moved 4.7% north in the past 60 days.

The bottom line of Enovis outpaced estimates in three of the trailing four quarters and matched the mark once, the average surprise being 6.18%. The Zacks Consensus Estimate for ENOV’s 2024 earnings indicates a 9.2% rise while the same for revenues implies an improvement of 24.7% from the respective prior-year figures. The consensus mark for ENOV’s earnings has moved 1.7% north in the past 30 days.

Ligand Pharmaceuticals’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 56.02%. The Zacks Consensus Estimate for LGND’s 2024 earnings indicates a 16% rise while the same for revenues implies an improvement of 6% from the respective prior-year tallies. The consensus mark for LGND’s earnings has moved up 3.3% in the past 30 days.

Shares of Organon and Ligand Pharmaceuticals have gained 42.7% and 12.1%, respectively, year to date. However, the Enovis stock has lost 20.1% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Organon & Co. (OGN) : Free Stock Analysis Report

Enovis Corporation (ENOV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance