A company you never heard of just became the biggest in Australia

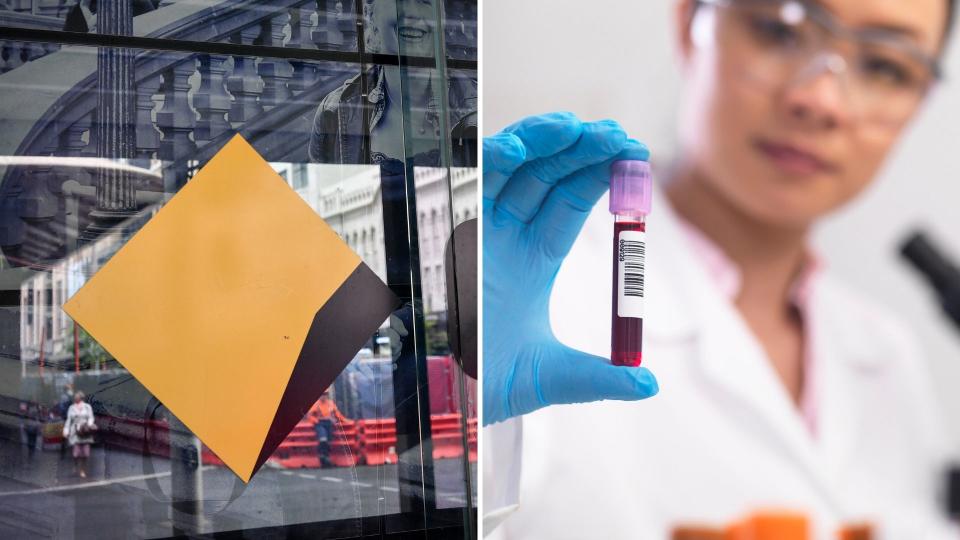

Familiar brand Commonwealth Bank has been toppled as the largest public company in Australia by a firm the Average Joe would never have heard of.

Commonwealth Bank of Australia shares dropped 1.7 per cent in value on Tuesday, to bring the bank's market capitalisation down to $140 billion at the close of trading.

This meant blood product company CSL, with a value of $142 billion, became the new Queen.

The toppling of Commonwealth Bank is significant because the Australian share market is dominated by the financial sector. According to Bloomberg, the big four banks – CBA, Westpac, ANZ and NAB – make up approximately 20 per cent of the ASX200 index.

What does CSL do?

CSL, like the Commonwealth Bank, used to be a federal government-owned entity.

It was founded in 1916 as Commonwealth Serum Laboratories before it went public in 1994. The organisation was critical in providing Australians with now-basic medical products like penicillin and insulin.

CSL now produces blood therapy products, plasma products and influenza vaccines.

CSL investors are laughing

CSL has, through developing its own unique products and acquiring overseas companies, seen spectacular growth in the 26 years since floating on the ASX.

The initial public offer share price was $2.30, but with various buybacks taken into consideration the effective price is around 76 cents, according to Bell Direct's Julia Lee.

This means $10,000 of shares purchased at the IPO in 1994 would be now worth more than $4 million.

And that's not including the dividends it has paid out in that time, which would total in the hundreds of thousands of dollars.

Disclosure: the journalist owns shares in CSL Limited.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance