Colfax's (CFX) Product Strength Aids Amid Cost & Supply Woes

Colfax Corporation CFX specializes in manufacturing and selling fabrication and medical-technology-related products and services. Solid fundamentals and product innovation are beneficial for the company. However, cost woes and high debts are worrying.

The Fulton, MD-based company presently carries a Zacks Rank #4 (Sell). The stock belongs to the Zacks Manufacturing – General Industrial industry, which comes under the ambit of the Zacks Industrial Products sector. The industry is in the bottom 33% (with a rank of 170) of more than 250 Zacks industries.

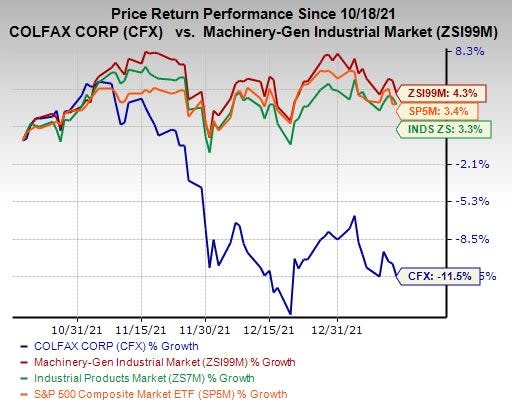

In the past three months, the company’s shares have decreased 11.5% against the industry’s growth of 4.3%. Also, the S&P 500 and the sector have gained 3.4% and 3.3%, respectively, during the same period.

Image Source: Zacks Investment Research

Factors Influencing Colfax

Colfax has operations in multiple end markets, including marine, power generation, general industrial, mining and petrochemical. Such diversification helps the company lower risks emanating from excessive reliance on a single or few markets. Also, the company’s solid product offerings, its innovation capabilities, healthy demand and productivity actions raise its attractiveness. Its acquisitive nature also boosts its growth prospects. In 2021, Colfax acquired Trilliant Surgical, MedShape and Mathys AG Bettlach.

The last few notable products unveiled by Colfax’s Fabrication Technology segment include Robust Feed AVS, GCE Druva, Sentinel and Rogue ET (portable welder machine). Then again, the launch of AltiVate Anatomic CS Edge, EMPOWR Dual Mobility Hip System, Motion iQ, DynaNail Hybrid Fusion System and other products was done by Colfax’s Medical Technology segment. In the quarters ahead, healthy growth in emerging nations and infrastructural investments are expected to benefit Fabrication Technology. The Medical Technology segment is likely to gain from population increase, aging, active lifestyles and sports.

Colfax is progressing well with the separation of its two businesses segments into two independent companies. This move, to be complete in the first quarter of 2022, is expected to help both businesses deliver high growth, strong free cash flow and margin expansion. Notably, Colfax’s Fabrication Technology segment will operate as ESAB Corporation and its Medical Technology segment will be known as Enovis Corporation, post split.

On the slip side, Colfax is facing costs and margin-related headwinds. In third-quarter 2021, it recorded a 21.5% increase in the cost of sales and a 20.3% expansion in selling, general and administrative expenses. Its gross margin fell 80 basis points (bps) year over year. In the quarters ahead, the company might continue to suffer from inflationary pressures, supply-chain woes, logistics issues and high taxes.

Colfax is also exposed to risks from a highly leveraged balance sheet and international operations. Dilutive impact of share issuance to fund Mathys’ buyout might impact earnings. For 2021, Colfax predicts year-over-year sales growth of 26-28% for the Medical Technology segment. This projection is lower than 28-31% growth expected earlier.

Sales growth for the Fabrication Technology segment is expected to be 24-25% for 2021, above the previously mentioned 21-23%. Adjusted earnings per share are expected to be at the low-end of $2.10-$2.20 projected earlier.

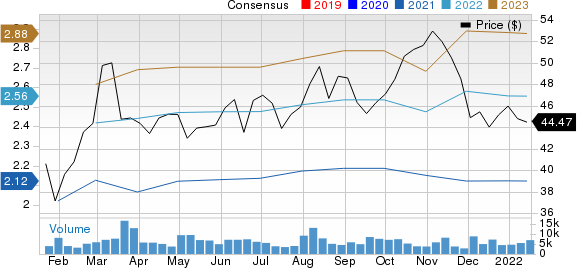

The Zacks Consensus Estimate for Colfax’s earnings per share is pegged at $2.12 for 2021 (results not yet released) and $2.56 for 2022, suggesting declines of 0.5% and 0.8%, respectively, from the respective 60-day-ago tallies. The earnings estimate for the fourth quarter is pegged at 58 cents per share, up 1.8% from the 60-day-ago figure.

Colfax Corporation Price and Consensus

Colfax Corporation price-consensus-chart | Colfax Corporation Quote

Stocks to Consider

Three better-ranked stocks from the industry are mentioned below.

Ferguson plc’s FERG results in the last-reported quarter were impressive, with an earnings beat of 16.82%. The company presently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ferguson’s earnings has increased 10.5% for fiscal 2022 (ending July 2022) in the past 60 days. FERG’s shares have gained 18.5% in the past three months.

Graco Inc. GGG presently carries a Zacks Rank #2 (Buy). The company’s earnings surprise in the last reported quarter was -10.94%. The same for the last four quarters was 6.58%, on average.

In the past 60 days, the Zacks Consensus Estimate for Graco’s earnings has increased 1.9% for 2022. GGG’s shares have rallied 5.1% in the past three months.

Alta Equipment Group Inc. ALTG reported weaker-than-expected results in the last-reported quarter, with earnings lagging estimates by 50.00%. Its earnings surprise in the last four quarters was -38.62%, on average. The company presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Alta Equipment’s earnings has increased 5.3% for 2022 in the past 60 days. ALTG’s shares have rallied 8.6% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Graco Inc. (GGG) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

Alta Equipment Group Inc. (ALTG) : Free Stock Analysis Report

Wolseley PLC (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance