Cognizant (CTSH) Q1 Earnings & Revenues Beat Estimates

Headquartered in Teaneck, NJ, Cognizant Technology Solutions Corp CTSH is a leading provider of information technology, consulting and business process outsourcing services. The company was spun off from Dun & Bradstreet in 1996 and went public in Jun 1998.

Cognizant primarily serves four domains: Financial Services, Healthcare, Manufacturing, Retail and Logistics and Other (includes Communications, Information, Media & Entertainment and High Technology).

Zacks Rank: Currently, Cognizant has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, that could change following Cognizant’s first-quarter 2018 earnings report which has just released.

We have highlighted some of the key details from the just-released announcement below:

Earnings: Cognizant reported non GAAP earnings of $1.06 per share, which beat the Zacks Consensus Estimate by a penny.

Revenues: Revenues of $3.91 billion also beat the Zacks Consensus Estimate and grew 10.3% year over year. The growth was driven by robust performance across all the four domains.

Key Stats: Cognizant’s non GAAP operating margin in the quarter was 20.3%, which expanded 140 basis points (bps).

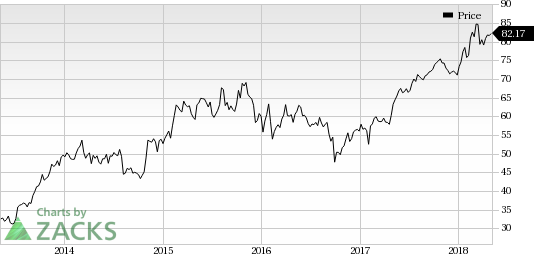

Cognizant Technology Solutions Corporation Price

Cognizant Technology Solutions Corporation Price | Cognizant Technology Solutions Corporation Quote

Stock Price: Stock price did not show any movement in the pre-market trading session.

Check back later for our full write up on this CTSH earnings report later!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance