CME Group (CME) Q2 Earnings Top Estimates, Revenues Miss

CME Group Inc. CME reported second-quarter 2019 adjusted earnings per share of $1.76, which beat the Zacks Consensus Estimate by 0.6%. The bottom line increased 1.1% year over year.

The company delivered the second-highest quarterly average daily volume in its history, with 21 million contracts per day, driven in part by record trading volume outside the United States and strong options activity. It also remained focused on controlling costs.

Performance in Detail

CME Group’s revenues of $1.3 billion increased 20.1% year over year. The top line however missed the Zacks Consensus Estimate by 0.6%. The year-over-year increase in revenues can be attributed to higher clearing and transaction fees (up 16.1% year over year), market data and information services (up 12.7% year over year), and other (up 133.2% from the prior-year period).

Total expenses increased 46.2% year over year to $574.1 million during the reported quarter, attributable to higher compensation and benefits, technology expenses, professional fees and outside services, licensing and other fee agreements, depreciation and amortization as well as other.

Operating income increased 4.8% from the prior-year quarter to $698.6 million.

Average daily volume increased 14% year over year to 20.9 million contracts in the quarter. Average rate per contract declined in five product lines.

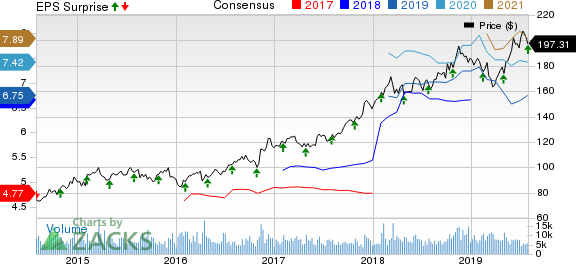

CME Group Inc. Price, Consensus and EPS Surprise

CME Group Inc. price-consensus-eps-surprise-chart | CME Group Inc. Quote

Financial Update

As of Jun 3, 2019, CME Group had $1 billion of cash and marketable securities, down 11.1% from 2018 end. As of Jun 30, 2019, long-term debt of $4.1 billion increased 6.4% from 2018 end.

As of Jun 30, 2019, the company had total assets worth $70.3 billion, down 9.2% from 2018 end.

Capital Deployment

CME Group paid $268 million in dividends in the second quarter. The company has returned about $11.8 billion to shareholders in the form of dividends since the implementation of the variable dividend policy in early 2012.

Zacks Rank

CME Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Securities Exchange Industry Players

Nasdaq’s NDAQ earnings beat the Zacks Consensus Estimate while that of MarketAxess Holdings MKTX missed expectations.

Upcoming Release

Intercontinental Exchange ICE is slated to report its second-quarter results on Aug 1 before market open. The Zacks Consensus Estimate is pegged at 92 cents, indicating 2.2% increase from the year-ago reported figure.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance