Clean Seas Seafood (ASX:CSS) Share Prices Have Dropped 47% In The Last Three Years

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Clean Seas Seafood Limited (ASX:CSS) shareholders have had that experience, with the share price dropping 47% in three years, versus a market return of about 32%. The falls have accelerated recently, with the share price down 32% in the last three months.

Check out our latest analysis for Clean Seas Seafood

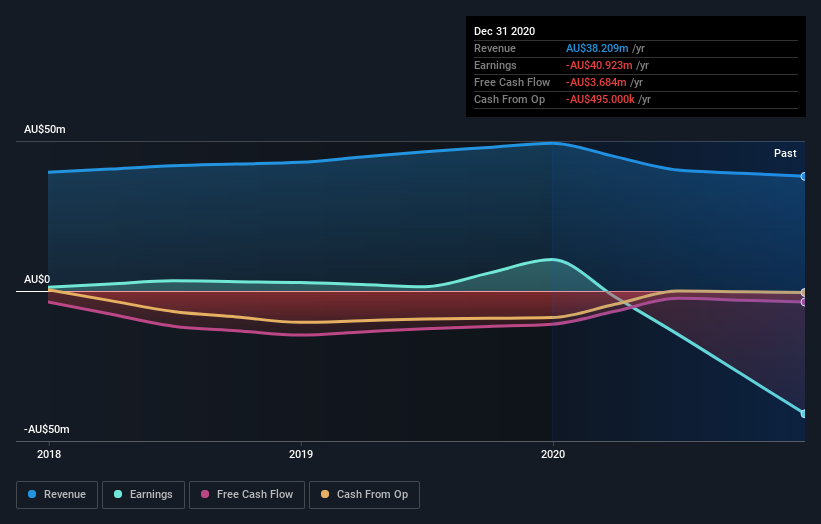

Because Clean Seas Seafood made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Clean Seas Seafood saw its revenue grow by 0.1% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 14% during that time. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Clean Seas Seafood had a tough year, with a total loss of 11%, against a market gain of about 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Clean Seas Seafood better, we need to consider many other factors. For example, we've discovered 4 warning signs for Clean Seas Seafood (1 can't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance